Retirement planning is crucial for ensuring a comfortable and secure life after your working years. Unfortunately, many people make common mistakes that can jeopardize their financial stability in retirement. By being aware of these pitfalls and actively working to avoid them, you can secure your financial future and enjoy your retirement years to the fullest. In this article, we will discuss the top ten mistakes people make when planning for retirement and how you can avoid them.

The importance of early planning cannot be overstated. Starting your retirement savings early allows for compound interest to work in your favor, leading to a significant increase in savings over time. However, many individuals delay this essential process, either due to procrastination, lack of knowledge, or underestimating the time required to build a substantial retirement fund.

Understanding the potential risks and common errors in the planning process is vital. By identifying these mistakes early on, you can take the necessary steps to correct them and ensure a more secure and enjoyable retirement.

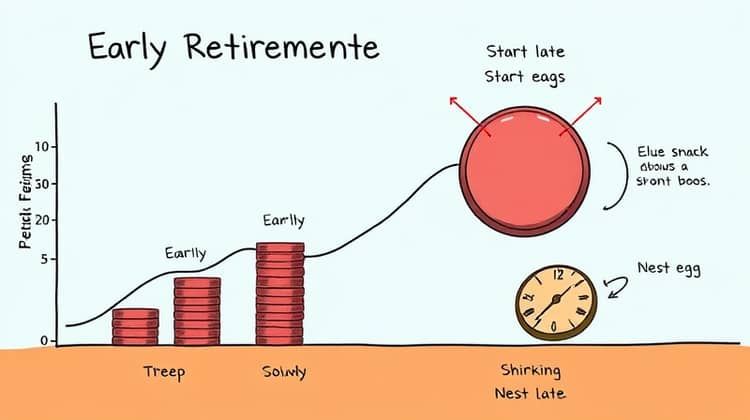

1. Starting Too Late

Many people put off retirement planning, thinking they still have time to start saving. This delay can be detrimental, as waiting to begin your retirement savings can result in a smaller nest egg when you finally do decide to retire.

The earlier you start saving for retirement, the more time your money has to grow. Delaying your contributions means losing out on the power of compound interest, which can significantly increase your savings over time. A late start can lead to feelings of anxiety and uncertainty about your future finances.

To combat this issue, setting clear financial goals and developing a timeline for achieving them can help you get on the right path. Even small contributions made early on can have a big impact down the line.

2. Underestimating Expenses

When planning for retirement, many individuals fail to accurately estimate their living expenses. This can lead to a shortfall in funds when you finally retire, leaving you struggling to cover your basic needs.

Expenses during retirement can vary significantly from pre-retirement, and factors such as lifestyle changes, inflation, and healthcare costs can all impact your budget. It is crucial to take into account these potential changes when projecting your retirement expenses.

- Create a detailed list of your anticipated expenses in retirement, including housing, travel, and leisure activities

- Factor in healthcare costs, as they are likely to rise significantly as you age

- Consider the impact of inflation and adjust your projections accordingly.

Being diligent in estimating your expenses can lead to a comfortable and stress-free retirement. Always remember that it's better to overestimate your costs and have a little extra savings than to underestimate and find yourself falling short.

3. Overestimating Social Security

Many retirees mistakenly assume that Social Security benefits will cover all their expenses in retirement. However, this is often not the case, as Social Security is designed to only replace a portion of your pre-retirement income.

Additionally, the amount you receive from Social Security may be less than you expect due to changes in legislation, benefit calculations, or personal employment history. It is essential to understand that Social Security should only be one piece of your overall retirement income puzzle.

To prepare for retirement accurately, it is advisable to develop multiple income sources and not rely solely on Social Security benefits, considering alternative savings and investment strategies.

4. Ignoring Inflation

Ignoring the impact of inflation is a common mistake among those planning for retirement. While savings might seem sufficient today, you must consider the increasing cost of living that will occur over the years. As prices rise, your initial savings may not stretch as far as you think.

It's essential to factor inflation into your retirement planning to ensure your savings maintain their value. Inflation erodes purchasing power, meaning that what you can buy today may cost significantly more in the future.

To combat inflation's effects effectively, building a diversified investment portfolio that can grow at a rate higher than inflation is necessary. This includes a mix of stocks, bonds, and other investment vehicles.

5. Failing to Diversify Investments

Investment diversification is a cornerstone of successful retirement planning. Failing to diversify can expose your retirement savings to unnecessary risks, particularly if you heavily invest in a single asset or sector. Risk management is crucial, especially as retirement savings should preserve capital while still growing.

To enhance your portfolio’s stability and reduce risk, you should possess a well-rounded mix of assets that includes equities, fixed income, real estate, and possibly alternative investments. This way, if one area performs poorly, others may compensate.

A well-thought-out diversification strategy can counterbalance market fluctuations and help secure your financial future.

- Review and adjust your investment portfolio regularly to maintain an appropriate level of diversification

- Consider investing in low-cost index funds or ETFs for broader market exposure

- Seek the assistance of a financial professional to build a diversified portfolio that aligns with your goals.

By diversifying your investments and regularly reassessing your strategy, you can better protect your funds and ensure they last throughout retirement.

6. Not Considering Healthcare Costs

Healthcare expenses can be one of the most significant costs during retirement, yet many people fail to adequately plan for them. As you age, the likelihood of requiring medical care increases, leading to potential financial strain if not properly budgeted.

It is important to anticipate both out-of-pocket healthcare costs and long-term care options. Medicare may cover some expenses, but there are still many costs that retirees need to shoulder. Therefore, having a financial plan in place is critical.

Incorporating healthcare costs into your overall retirement financial plan is essential for realistic budgeting and ensuring peace of mind well into your later years.

- Investigate supplemental health insurance options to cover additional expenses

- Set aside a separate savings account dedicated to healthcare costs

- Consider long-term care insurance to prepare for any unexpected health-related expenses.

Taking these steps to plan for healthcare costs can prevent unpleasant financial surprises in retirement, ensuring that your health needs do not compromise your standard of living.

7. Not Having a Clear Withdrawal Strategy

Creating a withdrawal strategy is crucial for effectively managing your retirement funds. Without a straightforward plan, you risk depleting your savings too quickly or leaving too much untouched, which may lead to unnecessary tax burdens or loss of opportunity.

When considering how to withdraw funds from your retirement accounts, it's essential to establish priorities and develop a systematic approach. This strategy may involve withdrawing from accounts based on tax implications, minimum distributions, or personal needs.

A coherent withdrawal strategy is key in balancing your cash flow, tax obligations, and ensuring your savings last throughout your retirement.

- Determine which accounts to withdraw from first to minimize taxes

- Create a yearly budget to monitor your expenses and income

- Consider the timing of withdrawals to align with your tax situation.

By having an organized withdrawal strategy, you can maintain financial stability while enjoying retirement without the fear of running out of money.

8. Relying Solely on Spouse’s Retirement Accounts

For couples, it's common to rely on one partner's retirement accounts for financial security in retirement. However, depending solely on one spouse's savings can be a risky strategy and may lead to financial complications in the long run.

Each partner should ideally have their own retirement savings to ensure individual financial independence and security. This approach mitigates risks associated with divorce, the death of a partner, or the simple unpredictability of retirement costs. Additionally, it allows both spouses to better plan for the future with a complete understanding of their financial situations.

Understanding that retirement planning should be a joint effort can lead to healthier financial habits and ultimately, a more secure retirement for both partners.

9. Not Reviewing or Updating Your Plan

Retirement planning is not a one-time event; it requires regular reviews and adjustments based on changes in life circumstances, market conditions, or personal goals. Failing to update your retirement plan can lead to financial shortfalls or unmet goals.

Life events, such as marriage, divorce, job loss, or health issues, can significantly affect your retirement strategy. Staying flexible and revisiting your plan will allow you to adapt to changing circumstances and ensure you remain on track to meet your goals.

- Make it a habit to review your retirement plan at least annually

- Adjust your savings rate or investment strategy based on changes in income or expenses

- Stay informed about market conditions that might affect your investments or overall retirement strategy.

Regularly reviewing and updating your plan ensures you stay prepared for whatever life may throw your way, putting you in a strong position for a successful retirement.

10. Lack of Professional Guidance

Navigating the complexities of retirement planning can be overwhelming, and many people make critical errors simply due to a lack of knowledge. Engaging with a financial advisor can help you create a comprehensive retirement plan tailored to your specific goals and financial situation.

Professional guidance can make a significant difference, especially when dealing with taxes, investment strategies, and estate planning. Advisors can provide insights and expertise that can enhance your financial knowledge and ensure that your plan is robust and effective.

Conclusion

In conclusion, avoiding these common retirement planning mistakes can significantly improve your chances of having a secure and enjoyable retirement. By taking proactive steps to educate yourself and create a comprehensive plan, you can ensure that you are well-prepared for the future.

Remember that retirement planning is a lifelong process, and it’s essential to remain flexible and adaptable. Regular reviews and adjustments to your plan will help you make the necessary changes to achieve your retirement goals effectively.