In today's financial landscape, retirement planning is more multifaceted than ever. Retirees are tasked with ensuring their portfolios are well-structured to withstand economic volatility, health crises, and unforeseen expenses. One of the most effective strategies to manage these risks is diversification. This article will delve into the various strategies for diversifying your retirement portfolio, helping you to make informed decisions for a secure financial future.

Diversification involves spreading investments across various asset classes and geographic regions to reduce overall risk. A well-diversified portfolio can provide vulnerable retirees with a buffer against market fluctuations and help maintain their purchasing power. It ensures that, should one investment perform poorly, others may perform well enough to compensate for potential losses.

Investors must recognize that diversification does not eliminate risks entirely but is a method of managing them. In the context of retirement, where income streams may become fixed, maintaining a diverse portfolio can contribute significantly to long-term financial health. Through careful planning and execution, retirees can enjoy peace of mind knowing their portfolios can weather different economic scenarios.

Why Diversification is Crucial

Diversification is one of the fundamental principles of investing, particularly vital in retirement planning. Retirees often rely on their portfolios to generate income, which makes the stakes higher. A significant market downturn can drastically affect one’s ability to withdraw the necessary funds, which is why a diversified approach is essential.

As individuals transition into retirement, they usually shift their focus from wealth accumulation to income preservation. This change in focus necessitates adopting strategies that manage risks while also providing for income needs. A diversified portfolio can better withstand the market's cyclical nature and mitigate potential losses during economic downturns.

Additionally, the unpredictable nature of economic cycles means that individuals need to prepare for market fluctuations. A portfolio that is diversified across various investments – including different sectors, asset classes, and geographies – can help to stabilize returns over time. As such, understanding and implementing diversification strategies is a key component of a robust retirement plan.

1. Asset Allocation

Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, real estate, and cash. This strategy is crucial for managing risk and achieving desired investment outcomes. Selecting the right mix depends on factors such as your risk tolerance, investment goals, and time horizon for retirement.

A well-thought-out asset allocation strategy helps to balance risk and reward in your retirement portfolio. Over the long term, different asset classes react differently to market conditions, allowing for smoother overall returns. For individuals nearing retirement, a more conservative allocation may be prudent to protect against potential market declines.

- Balance the risks and rewards based on your risk tolerance.

- Consider the time horizon for your investments and your retirement.

- Adjust the asset mix as you age or as your financial situation changes.

Implementing a sound asset allocation strategy involves periodic reviews and adjustments. As market conditions fluctuate and life circumstances change, it is essential to realign your investments to maintain your desired risk level. Staying flexible and responsive will help guard against unforeseen financial challenges while optimizing potential returns.

Ultimately, asset allocation can significantly impact your retirement outcome. By diversifying within and across asset classes, retirees can increase their chances of meeting their financial goals while decreasing their exposure to market risks.

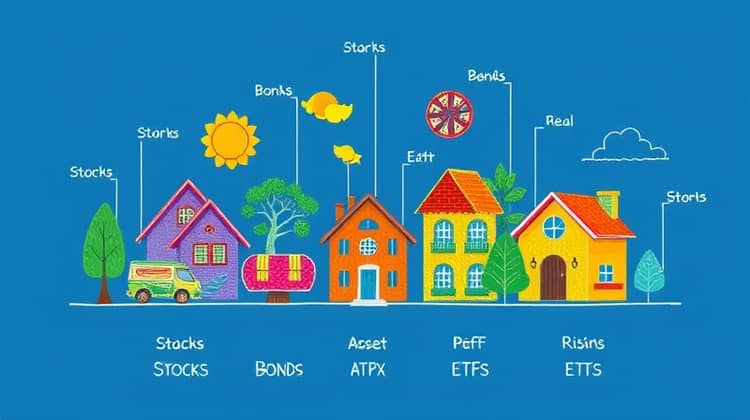

2. Types of Assets

When considering diversification, it's crucial to be aware of the different types of assets that can be included in your retirement portfolio. Familiarity with these options allows for informed decision-making. The main types of assets include stocks, bonds, real estate, and mutual funds or ETFs, each offering unique benefits and risks.

Understanding the fundamentals of each asset class can help retirees decide how to distribute their investments. This knowledge also helps in timing purchases and exits from various investments to maximize returns and minimize losses.

a. Stock Markets

Stocks represent ownership in companies, offering potential growth and income through dividends. Investing in stock markets is often considered a long-term growth strategy, but it does come with its share of risk, especially in the short term.

Investors can diversify within the stock market by allocating their capital across different sectors, industries, and geographic regions. This ensures that if one sector experiences a downturn, others may offset losses. Furthermore, many retirees opt to invest in dividend-paying stocks, which can provide a reliable income stream during retirement.

b. Bond Markets

Bonds are debt instruments issued by governments or corporations to raise capital. They typically carry less risk compared to stocks and can provide a steady income stream through interest payments. For retirees, adding bonds to an investment portfolio can offer stability and reduce the overall volatility of their assets.

There are various types of bonds such as municipal bonds, corporate bonds, and government bonds, each with different levels of risk and returns. A well-diversified bond portfolio can shield retirees from interest rate fluctuations and help secure income during market downturns. Furthermore, as retirees seek to preserve capital, bonds often serve as a counterbalance to riskier assets like equities, thus enhancing the portfolio's robustness.

c. Real Estate

Investing in real estate can provide not only capital appreciation but also consistent cash flow through rental income. Real estate investment offers a way to diversify outside of traditional financial markets, which can mitigate risks associated with stock and bond volatility. For retirees, owning rental properties can create passive income streams that support their retirement lifestyle.

Additionally, real estate often tends to appreciate over the long term, which can provide a hedge against inflation. With the increasing costs of living, real estate investments can be highly beneficial as they can offer both growth and income generation opportunities. It is vital, however, to consider the location and property type to maximize returns and minimize risk.

d. Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) provide retirees with an efficient way to achieve instant diversification without needing to select individual securities. These funds pool money from multiple investors to purchase a diversified basket of stocks, bonds, or other assets, which reduces the risks compared to investing in single stock or bond investments.

Both mutual funds and ETFs are managed by professionals who conduct research and make investment decisions on behalf of the investors. This professional management, coupled with the inherent diversification of these funds, allows retirees to access various investment opportunities while minimizing the time required to manage their own portfolios effectively.

3. Geographical Diversification

Geographical diversification refers to spreading investments across different countries or regions. This strategy is crucial as economic conditions can vary significantly from one country to another. Geographical diversification helps to minimize risks associated with local market downturns and sector-specific events.

Investing in international markets can enhance the growth potential of a retirement portfolio. By allocating a portion of investments to emerging markets or developed economies outside the investor's home country, retirees can tap into growth opportunities that may not be available domestically. Diversifying geographically also provides exposure to different currency valuations, further enhancing returns and providing added protection against local economic uncertainties.

4. Risk Management

Effective risk management is essential for maintaining a healthy retirement portfolio. It involves identifying potential risks to investments and implementing strategies to mitigate those risks. A retiree must assess various factors, including market conditions, interest rates, and overall economic outlook, to establish a robust risk management framework.

Diversification is a key element of risk management. By spreading investments across various asset classes, sectors, and geographical regions, retirees can reduce the impact of adverse events on their portfolio. Additionally, utilizing tools such as stop-loss orders, insurance products, and hedging strategies can further safeguard a retirement portfolio from significant financial downturns.

5. Regular Rebalancing

Regularly reviewing and rebalancing your investment portfolio is vital for maintaining your desired risk level. Over time, different assets will appreciate or depreciate, leading to a shift in your asset allocation. Rebalancing involves buying and selling assets to realign the portfolio with your initial allocation strategy.

For retirees, rebalancing ensures that their portfolio does not become overly exposed to higher-risk investments as market conditions change. Setting a specific schedule for rebalancing, whether it is annually or semi-annually, can help maintain discipline and avoid emotional decision-making influenced by market swings.

6. Preparing for Different Retirement Scenarios

When planning for retirement, it’s essential to prepare for various scenarios that could arise. These may include an unexpected rise in healthcare costs, market volatility affecting your investments, or a change in lifestyle that requires additional funds. Having a diversified portfolio helps ensure you can adapt to these scenarios effectively.

Understanding potential future expenses and income sources can help retirees avoid running out of money. By anticipating various financial scenarios, you can better prepare your portfolio to withstand changes, ensuring a reliable income throughout your retirement years.

- Evaluate your health care needs and establish a budget accordingly.

- Consider diversifying income sources, such as part-time work or freelance opportunities.

- Plan for fluctuations in investment income by maintaining adequate cash reserves.

By having a comprehensive plan to address various retirement situations, retirees can foster greater confidence in their financial security and minimize the impact of unforeseen events.

Consult a Financial Advisor

Consulting a financial advisor can provide retirees with invaluable insights and guidance on how best to diversify their portfolios. Advisors possess expertise in navigating various markets and asset classes, helping to tailor investment strategies to individual needs and circumstances.

Engaging with a professional can help clarify ambiguous aspects of portfolio management and retirement planning. Financial advisors can also offer tailored advice on risk management and asset allocation, ensuring that a retiree's portfolio remains aligned with their long-term goals. Moreover, they can assist in identifying emerging opportunities, thus enhancing the potential for growth and stability in turbulent times.