Green loans provide an innovative financial solution for homeowners and businesses looking to invest in energy-efficient upgrades. They are specifically designed to fund projects that have positive environmental impacts, making it easier for individuals and organizations to contribute to sustainability efforts. By understanding green loans and their benefits, you can make informed decisions that benefit not only your finances but also the environment.

In recent years, the popularity of green loans has surged as awareness of climate change and environmental degradation has increased. Lenders are looking to support initiatives that reduce carbon footprints and promote energy conservation. This blog aims to give you a comprehensive overview of green loans, financial benefits associated with them, and the types of upgrades they can fund.

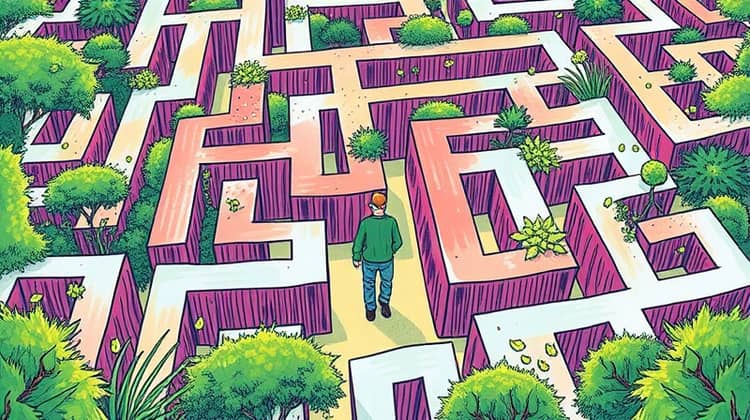

As you explore the potential of green loans, it is crucial to consider the challenges and opportunities involved. Being informed about the requirements and responsibilities will help you navigate through the process more effectively and maximize the positive impact of your investment. Let's dive in to understand what green loans entail and how they can enhance both home efficiency and ecological welfare.

Understanding Green Loans

Green Loan Characteristics

Green loans are specialized financing options that aim to support eco-friendly initiatives and projects that enhance energy efficiency. They cater to a wide range of upgrades, from renewable energy installations to energy-efficient appliances, fostering a sustainable lifestyle. By understanding the unique characteristics of green loans, you can determine whether they align with your financial goals and environmental values.

One of the defining features of green loans is their focus on loans that are secured by the investment made in energy-efficient assets or technologies. This means that the money you borrow is directly tied to the implementation of these upgrades, often leading to significant utility bill savings and overall reduced energy consumption. Additionally, these loans may come with preferential rates or terms as a motivation for borrowers to invest in sustainability.

Green loans can be offered by various lenders, including banks and specialized lending institutions. Borrowers may also find different types of green loans available, such as personal loans, home equity loans, and commercial financing options. It is important to compare rates and terms across options to find the best solution for your energy-efficient upgrade project.

- Specialized for energy-efficient upgrades

- Often comes with lower interest rates

- Can be secured against the energy-efficient asset

These characteristics make green loans an attractive option for individuals and companies committed to making a positive environmental impact while also enjoying potential financial benefits.

Benefits of Green Loans

Financial Benefits

Investing in energy-efficient upgrades through green loans not only benefits the environment but also offers various financial advantages. Lower monthly energy bills are one of the most tangible financial benefits resulting from energy-efficient installations. For example, switching to LED lighting or high-efficiency appliances can lead to substantial savings in utility costs over time.

In addition to lower energy bills, many green loans provide favorable interest rates compared to conventional loans, thereby reducing the overall cost of borrowing. This can make financing energy-efficient upgrades more accessible for homeowners and businesses. Grantees may also qualify for additional perks, such as tax credits or rebates, further enhancing the financial viability of their projects.

Moreover, investing in energy-efficient upgrades can increase the value of your property. Homes and commercial buildings equipped with modern, efficient technology tend to attract buyers and tenants, providing a potential return on investment that goes beyond initial energy savings.

- Reduced monthly utility costs

- Lower interest rates compared to standard loans

- Potential tax credits and rebates

These financial benefits make green loans an appealing option for those looking to improve their energy efficiency while also enjoying immediate and long-term savings.

Environmental Benefits

Green loans promote environmental sustainability by encouraging individuals and businesses to make energy-efficient upgrades that reduce their carbon footprints. By investing in eco-friendly projects, borrowers can play a critical role in the broader movement toward climate action and environmental conservation.

The positive impacts of energy-efficient upgrades extend beyond the immediate energy savings. These improvements contribute to decreased greenhouse gas emissions, reduced reliance on fossil fuels, and improved air quality. All of these factors play a significant role in combatting climate change and promoting a healthier planet.

- Reduced greenhouse gas emissions

- Conservation of natural resources

- Improved indoor air quality

Through green loans, borrowers can achieve both financial savings and substantive environmental benefits, creating a win-win situation for themselves and society at large.

Types of Energy-Efficient Upgrades Eligible for Green Loans

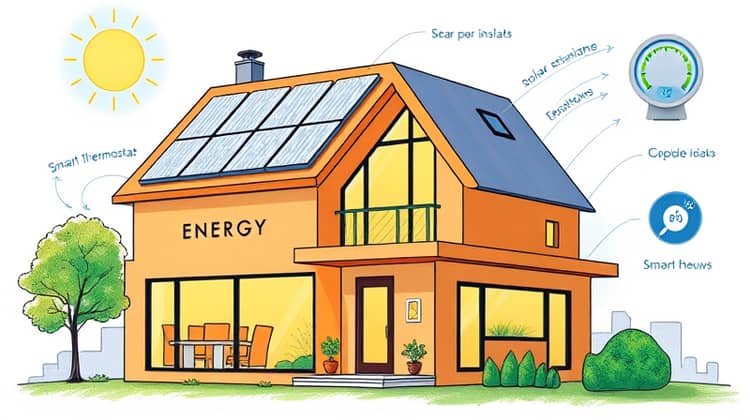

Green loans can be used to finance a variety of energy-efficient upgrades designed to lower energy consumption and environmental impact. Understanding what types of upgrades are eligible can help you plan your projects effectively and make the most of available financing solutions.

Common upgrades funded by green loans include solar panel installations, energy-efficient heating and cooling systems, and advanced insulation techniques. Each of these upgrades not only helps reduce energy usage but also improves the overall comfort of a building.

- Solar panel installations

- Energy-efficient HVAC systems

- High-performance windows and doors

- Smart thermostats and energy management systems

This versatility ensures that many borrowers can find eligible projects that align with their sustainability goals and financial needs.

How to Secure a Green Loan

Securing a green loan typically involves similar processes as obtaining a traditional loan, with some additional considerations related to the sustainability of the proposed upgrades. Borrowers should assess their project's scope, costs, and potential energy savings before approaching lenders.

- Research lenders that offer green loans

- Prepare necessary documentation related to your financial standing

- Provide information about the energy-efficient project you want to fund

- Review loan terms and finalize the application

By following these steps, you can navigate the process of securing a green loan efficiently and effectively.

Challenges and Considerations

Common Challenges

While green loans offer numerous benefits, borrowers may face challenges throughout the process. One common obstacle is the limited availability of lenders offering green-specific programs. Not all financial institutions have adopted green lending practices, which may require potential borrowers to do extensive research to find suitable options.

Additionally, borrowers may face stricter eligibility criteria when applying for green loans compared to traditional loans. This can include requirements related to credit scores, income verification, or adherence to certain project specifications.

- Limited availability of green loan providers

- Stricter eligibility requirements

- Need for comprehensive project documentation

These challenges should be considered and addressed early in the application process to increase the chances of securing the desired loan.

The Future of Green Loans

As awareness of climate change continues to grow, the demand for green loans is likely to increase. More lenders are beginning to recognize the importance of sustainable finance and are developing tailored products to meet the needs of environmentally conscious borrowers. As this trend continues, we can expect to see greener financing solutions become more mainstream.

Technological advancements in the clean energy sector will also play a critical role in shaping the future of green loans. New innovations and energy-efficient equipment will emerge, offering even more savings and improved performance, thus attracting more investments through green financing.

In addition to technological changes, government regulations and incentives will further influence the evolution of green loans. Policymakers are likely to introduce measures that encourage energy efficiency and sustainability, paving the way for higher adoption rates of green loan products.

Overall, the future of green loans looks promising. With increased awareness and support for environmental initiatives, these loans may become an essential part of financial planning and real estate development, driving the transition towards a more sustainable economy.

Conclusion

In conclusion, green loans present an exciting opportunity for borrowers seeking to invest in energy-efficient upgrades that will benefit both their wallets and the environment. Understanding the characteristics of these loans, their benefits, and the types of projects eligible for funding can empower individuals and businesses to make informed financial decisions.

While challenges such as limited lender availability and stricter eligibility may pose hurdles, being well-informed and prepared can enhance your chances of successfully obtaining a green loan. As more financial institutions recognize the importance of sustainability, these products will likely become more accessible over time.

As we strive to achieve a more sustainable future, incorporating green loans into your financial strategy can contribute significantly to reducing energy consumption and environmental impact, paving the way for a greener planet.