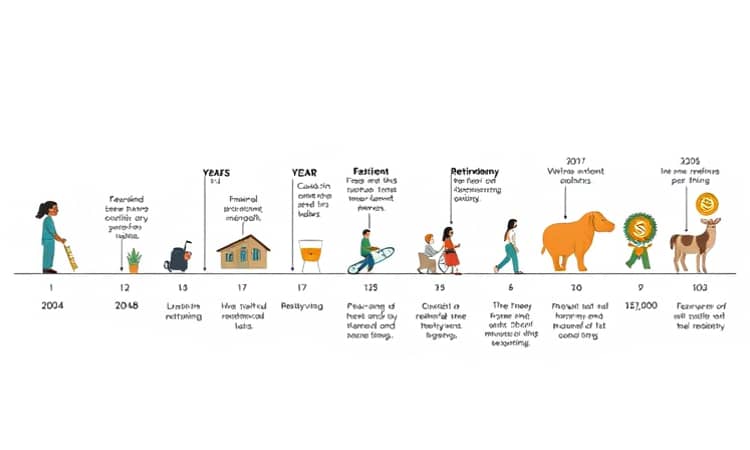

As the years go by, our lives change in various ways, including our financial situations, goals, and health. Retirement planning is not a one-time event but a continuous process that requires periodic assessment and adjustment. Making changes to your retirement plan ensures that it remains aligned with your current needs and future objectives.

Individuals should be aware that external factors, such as economic conditions, market performance, and changes in tax laws, can significantly impact retirement savings and investments. Therefore, staying vigilant and proactive about adjustment can help avoid pitfalls in achieving retirement goals.

In this guide, we will explore why it is crucial to adjust your retirement plan over time, the key factors that may necessitate adjustments, and the steps you can take to ensure a fruitful retirement.

Why Is It Important to Adjust Your Plan?

One of the primary reasons to adjust your retirement plan is to ensure it accurately reflects your evolving personal circumstances. As you transition through different life stages, such as marriage, having children, or changing jobs, your financial situation and objectives may shift. What was once a feasible retirement strategy can become outdated or insufficient to meet your needs.

Inflation is another critical element that affects retirement savings. The cost of living increases over time, which means that your purchasing power may decline if your retirement savings do not keep pace. Regularly adjusting your retirement plan allows you to factor in inflation and ensure that your future standard of living remains intact.

Furthermore, adjusting your retirement plan helps you stay on track with your savings goals. Life events can sometimes derail your saving efforts, leading to a shortfall in your retirement funds. By reviewing and recalibrating your plan regularly, you can identify any gaps and make necessary corrections.

- Life changes necessitate a reassessment of your financial objectives.

- Inflation impacts purchasing power, making adjustments crucial.

- Regular reviews help track progress and keep goals achievable.

By acknowledging these aspects, you can approach your retirement planning with a more strategic mindset, ensuring you remain prepared for whatever challenges may arise.

Key Factors That May Require Adjustments

Several key factors can arise, warranting a thorough review and potential adjustment of your retirement plan. Changes in your career, whether positive or negative, can have a significant effect on your finances. An unexpected job loss might reduce your income, prompting you to lower your retirement contributions or revise your timelines.

On the other hand, a raise or promotion may allow you to accelerate your savings, making it essential to revisit your contributions to maximize retirement funds accordingly. Additionally, changes in marital status, such as divorce or remarriage, may lead to alterations in financial goals and responsibilities that could influence your retirement outlook.

- Changes in employment status (layoffs, promotions) affect savings potential.

- Marital status changes impact financial responsibilities.

- Health issues may alter retirement timing and needs.

By acknowledging these shifts, you can keep your retirement plan relevant and effective for your life changes.

Steps to Adjust Your Retirement Plan

Evaluate Your Current Situation

Start by assessing your current financial situation. Determine how much you have saved for retirement, your expected retirement income, and your current expenses.

- Calculate your total savings and current retirement accounts.

- Consider your expected retirement expenses, including healthcare, housing, and leisure activities.

- Determine any other sources of retirement income, such as Social Security or pensions.

This evaluation acts as a baseline to identify potential gaps in your retirement funding and needs.

Review Investment Strategy

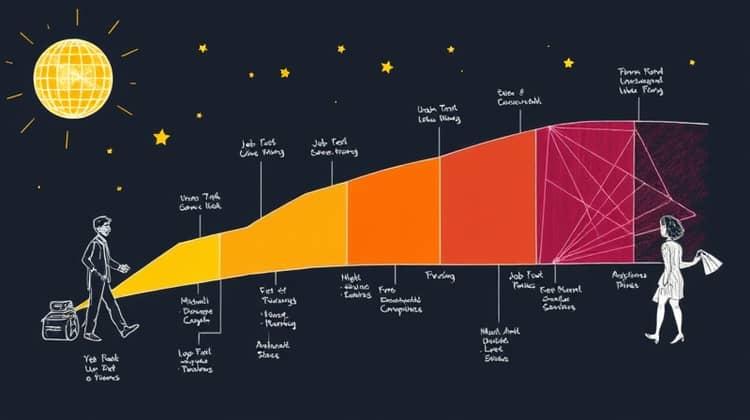

Your investment strategy plays a crucial role in your retirement planning. As the market changes, so too should your approach to investing. For instance, if you are closer to retirement, it may be wise to shift towards more conservative investments to protect your savings from market volatility.

Alternatively, if you have a longer time until retirement, you might prefer to invest in more aggressive asset classes that could yield higher returns over time. Regularly evaluate your investment performance and adjust as necessary to align with your risk tolerance and retirement timeline.

- Assess your current investment strategy for alignment with retirement goals.

- Make adjustments based on market performance and personal risk tolerance.

- Consider diversifying your portfolio to minimize risks.

A well-reviewed investment strategy can significantly enhance your ability to meet your retirement goals, keeping you secure and comfortable in your later years.

Conclusion

In summary, adjusting your retirement plan is an invaluable part of securing a comfortable future. Regularly revisiting your financial circumstances, key influences on your savings, and your investment strategy can help ensure that your retirement plan remains on track, adapting as needed to meet changes and challenges. By taking a proactive approach, you can work towards achieving your retirement dreams with confidence.