As retirement approaches, the importance of having a solid financial plan becomes increasingly clear. Retirement savings accounts are crucial tools that can help individuals secure their financial future after they stop working.

In this article, we will explore some of the most common types of retirement savings accounts, their benefits, and how they can fit into your overall retirement strategy.

1. Traditional Individual Retirement Account (IRA)

A Traditional IRA is a popular retirement savings account that allows individuals to contribute pre-tax income, which can then grow tax-deferred until withdrawal. This tax advantage helps individuals minimize their taxable income in the years they contribute.

When you withdraw funds from a Traditional IRA during retirement, those withdrawals are taxed as ordinary income. This structure makes Traditional IRAs particularly appealing for those who expect to be in a lower tax bracket when they retire.

- Tax-deferred growth: Contributions grow tax-free until withdrawal.

- Potential tax deductions: Contributions may be tax deductible, lowering taxable income.

- Wide range of investment options: IRAs can hold stocks, bonds, mutual funds, and more.

Choosing a Traditional IRA can be a strategic way to manage future tax liabilities while building a substantial nest egg for retirement.

2. Roth IRA

The Roth IRA is another type of individual retirement account, but it operates differently than the Traditional IRA. Contributions to a Roth IRA are made with after-tax dollars, meaning you pay taxes upfront and can withdraw funds tax-free in retirement.

This unique structure offers flexibility in retirement, especially for those who anticipate being in a higher tax bracket when they retire, as withdrawals of contributions and earnings are tax-free if certain conditions are met.

- Tax-free withdrawals: All qualified distributions are tax-free.

- No required minimum distributions (RMDs): Unlike Traditional IRAs, Roth IRAs do not require withdrawals during the owner’s lifetime.

- Flexible contribution rules: You can withdraw contributions at any time without penalty.

A Roth IRA might be ideal for younger workers who want to pay taxes now, allowing their savings to grow tax-free until retirement.

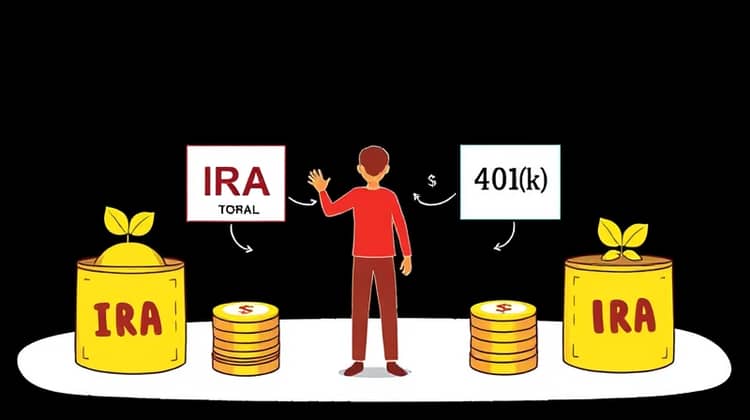

3. 401(k) Plans

401(k) plans are employer-sponsored retirement savings plans that allow workers to save a portion of their paycheck before taxes are taken out. Many employers offer matching contributions, which can significantly boost retirement savings.

The contributions and any earnings grow tax-deferred until withdrawal, typically at retirement age, when they will be taxed as ordinary income. This accounts for one of the most commonly used retirement savings options in the United States.

- Empoyer matching: Many employers offer to match employee contributions, providing free money to employees' retirement savings.

- Higher contribution limits: 401(k) accounts allow for larger annual contributions compared to IRAs.

- Immediate tax benefits: Contributions are tax-deductible, reducing taxable income for the year.

401(k) plans can be an excellent way for individuals to save for retirement, especially when factoring in employer contributions that effectively enhance savings.

4. Simplified Employee Pension (SEP) IRA

The SEP IRA is a retirement plan designed for self-employed individuals and small business owners. It allows employers to contribute to their own retirement and to their employees' retirement savings. Contributions are made on a pre-tax basis and can significantly reduce the taxable income for the business owner.

With relatively less administrative burden, SEP IRAs can be an excellent way for small businesses to provide retirement benefits. The contribution limits for SEP IRAs are generally higher than traditional and Roth IRAs, giving business owners the ability to save more for retirement.

- High contribution limits: Employers can contribute up to 25% of an employee's salary, with a maximum limit set annually.

- Low administrative costs: Easier to set up and maintain than other plans, such as 401(k)s.

- Flexible contributions: Employers can vary contributions from year to year based on business performance.

Overall, a SEP IRA can be a powerful retirement savings tool particularly suited to the needs of self-employed individuals or those running small businesses.

5. Savings Incentive Match Plan for Employees (SIMPLE) IRA

The SIMPLE IRA is a retirement plan that allows employees and employers to contribute to traditional IRAs set up for employees. This plan is particularly advantageous for small businesses with fewer than 100 employees who want to provide a retirement option without the complexity of a 401(k) plan.

Employers are required to make contributions to the SIMPLE IRA, either through matching employee contributions or making non-elective contributions on behalf of employees, ensuring that workers benefit from their company’s retirement plan.

- Employee contributions: Employees can contribute a portion of their salary, similar to a 401(k).

- Employer contribution requirement: Employers must match employee contributions up to 3% or make a 2% non-elective contribution.

- Lower setup costs: Simpler and less costly than other retirement plans.

The SIMPLE IRA can be an effective way for small businesses to offer a retirement savings option that encourages employee participation while keeping administrative tasks manageable.

Choosing the Right Account

When determining which retirement savings account is best for you, it’s essential to assess your financial situation, retirement goals, and tax implications. Each account type has distinct characteristics that may appeal to you based on your income, lifestyle, and career stage.

Consider your current and expected future income, as this will influence whether you prefer pre-tax savings (as with Traditional IRAs and 401(k)s) or after-tax savings (as with Roth IRAs). Additionally, factor in the contribution limits, employer matching options, and any required minimum distributions associated with each plan.

Ultimately, the right choice hinges on aligning your retirement savings strategy with your present capabilities and future aspirations, ensuring that you maximize your potential for growth and benefit.

Conclusion

Retirement savings accounts are vital tools in preparing for financial independence in your later years. Each type—whether it’s a Traditional IRA, Roth IRA, 401(k), SEP IRA, or SIMPLE IRA—provides unique advantages and potential drawbacks. Understanding these distinctions allows individuals to make informed decisions about their future financial well-being.