Social Security benefits play a crucial role in providing financial security to millions of Americans. These benefits help fund retirement, disability, and family needs, enabling beneficiaries to maintain a standard of living when they can no longer work or face unexpected life events. Understanding how Social Security benefits work is essential for everyone, whether you are nearing retirement or just starting your career.

In this blog post, we will explore the various types of Social Security benefits offered, how they are calculated, and when it is best to begin receiving them. Additionally, we will cover the application process, the taxation of these benefits, and provide insights into common questions and concerns.

Lastly, effective planning for your future, including how to maximize your benefits, will help ensure financial stability in your later years. By understanding the Social Security system, you can make informed decisions about your financial well-being.

1. Understanding the Basics

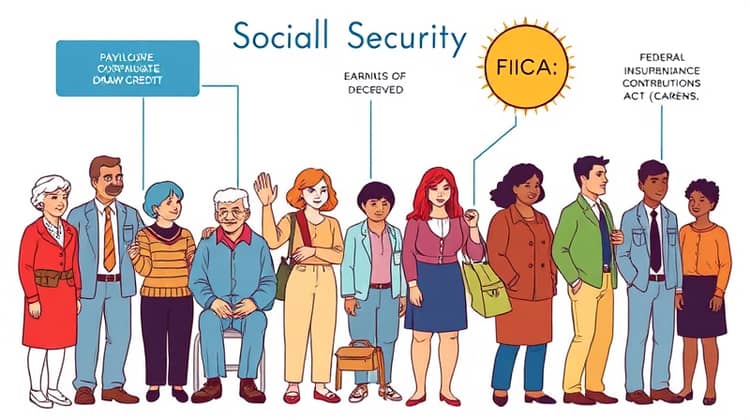

Social Security is a federal program established to provide financial assistance to individuals in various life circumstances, primarily aimed at those who are retired, disabled, or survivors of deceased workers. The program is funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA). Every time you work and pay Social Security taxes, you earn credits that contribute to your future eligibility for benefits.

Individuals generally become eligible for Social Security benefits upon reaching a certain age or if they become disabled according to specific criteria set by the Social Security Administration (SSA). Understanding these age thresholds and the qualification criteria is vital for anyone planning their retirement or assessing their financial safety net against unforeseen health issues.

Moreover, it’s important to remember that Social Security benefits are not designed to replace all income during retirement; rather, they are meant to supplement personal savings, pensions, and other income sources. This means that many workers may need to consider additional forms of retirement savings.

2. Types of Social Security Benefits

Social Security provides several types of benefits to cater to different individuals' needs, reflecting a holistic approach towards financial security. Understanding these types can help you ascertain which benefits might be applicable to your situation.

- Retirement Benefits

- Disability Benefits

- Survivor Benefits

- Dependent Benefits

Each of these benefits serves a distinct purpose, targeting specific groups such as retirees, those unable to work, or families that have lost a primary income earner, thereby fostering a safety net for various life circumstances.

3. How Social Security Benefits Are Calculated

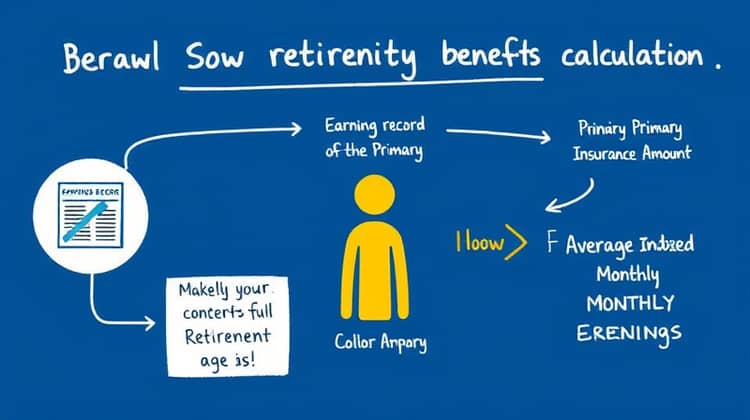

The calculation of Social Security benefits is primarily based on your earnings record. This record reflects your work history, with higher earnings leading to higher benefits. The SSA uses a formula to determine your Primary Insurance Amount (PIA), which is the amount you would receive at your full retirement age (FRA).

Another pivotal factor to consider is the Average Indexed Monthly Earnings (AIME), which averages your highest 35 years of earnings, adjusted for inflation. Your PIA is then computed utilizing your AIME in conjunction with re-calibrated percentages to ensure a higher benefit for lower-income earners.

Additionally, if you choose to take benefits before reaching your FRA, your monthly payments may be reduced, while delaying benefits past your FRA will result in increased monthly payments. These calculations reflect a careful balance intended to create fair and adequate benefits regardless of an individual's earnings history.

4. When to Start Receiving Benefits

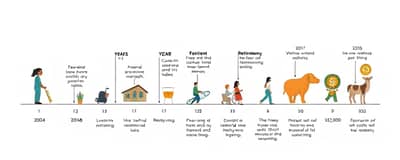

Deciding when to start receiving Social Security benefits can significantly impact your overall financial health during retirement. The full retirement age varies depending on the year you were born, but typically falls between 66 and 67. You can start receiving benefits as early as age 62, but your monthly payment will decrease if you opt for early benefits.

Alternatively, if you choose to delay receiving benefits beyond your FRA, you can earn delayed retirement credits which can increase your monthly payout. This decision requires careful consideration of your financial needs, overall health, and expected longevity, ensuring you choose the best course of action for your personal circumstances.

5. How to Apply for Social Security Benefits

Applying for Social Security benefits can seem daunting, but understanding the process can alleviate some stress. You can apply online, by phone, or in person at your local SSA office.

- Gather required documents (such as your Social Security number, birth certificate, and employment records)

- Complete the application online or print and fill out the form in advance for an in-person visit

- Be prepared for an interview regarding your work history and filing period

- Follow up on your application status after submission

By being organized and prepared, you can streamline the application process and minimize potential delays in receiving your benefits.

6. Taxation of Social Security Benefits

While many individuals rely on Social Security benefits to provide for their living expenses, it is essential to understand that these benefits may be subject to federal income tax. The taxation of Social Security benefits typically depends on your overall income level and filing status.

If you file taxes as an individual and your combined income is over $25,000 (or $32,000 for married couples), you may be required to pay taxes on a portion of your benefits. Conversely, if your income is lower than these thresholds, your benefits remain tax-free. Since Social Security benefits are treated as income for tax purposes, it is wise to plan for potential tax liabilities alongside your retirement strategy.

Furthermore, state taxes may also apply, depending on where you reside. It's prudent to consult with a tax professional to assess your specific situation and understand how these benefits impact your overall tax liability.

7. Common Questions and Concerns

As you navigate the complexities of Social Security benefits, you may encounter numerous questions and concerns. One common question is whether you can work while receiving benefits. You can work, but if you do reach certain income thresholds, your benefits may temporarily be reduced until you reach full retirement age.

Another frequent concern involves spousal benefits. Many individuals wonder if they can receive benefits based on their partner's work record, which is indeed possible under certain guidelines. Additionally, questions regarding how benefits may change in case of divorce or widowhood often arise.

People might also dwell on the implications of taking benefits early in terms of not just the monthly payout but also the lifetime amount received. Addressing these queries can provide peace of mind and better prepare individuals to make informed decisions.

Lastly, keeping abreast of updates, legislative changes, and alterations in Social Security policies is essential, as these elements can affect everyone relying on these benefits.

8. Planning for Your Future

Planning for your future involves not only understanding Social Security benefits but also ensuring that you have a comprehensive financial plan in place. As you approach retirement, consider evaluating other sources of income such as pensions, savings accounts, and investments to create a robust financial strategy.

Moreover, engaging with a financial advisor can offer additional insights into optimizing your Social Security benefits. This expert guidance can assist in determining the ideal time to file for benefits and suggest tailored strategies that align with your overall retirement goals.

Conclusion

Navigating the realm of Social Security benefits is vital for achieving financial stability in your later years. By understanding the various benefits available, the factors influencing eligibility, and the implications of taxes, you can take actionable steps towards effectively using Social Security as part of your broader retirement strategy.

Remember that preparation and informed decision-making are key. Whether you’re just starting your career or nearing retirement, knowing how to effectively utilize Social Security benefits will ultimately empower you to secure a brighter financial future.