Student loans are an essential aspect of financing higher education for many students across the United States. With tuition costs continuing to rise, understanding the various repayment options available for federal and private student loans is crucial. Making informed choices can significantly impact a borrower’s financial future.

This article will guide you through the different types of federal and private student loans, repayment plans, loan forgiveness options, consolidation, refinancing possibilities, and will help you navigate the often complex landscape of student debt management.

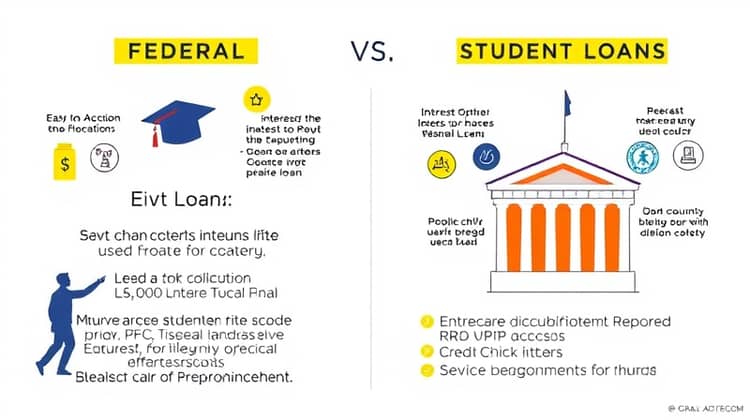

Federal vs. Private Student Loans

Federal student loans are issued by the government and generally offer better borrowing terms, including lower interest rates and flexible repayment options. These loans do not require a credit check, making them accessible for most students, regardless of their financial backgrounds. Additionally, federal loans come with built-in protections, such as deferment and forbearance options.

On the other hand, private student loans are offered by banks and financial institutions. These loans often require a credit check and may carry higher interest rates, depending on the borrower's creditworthiness. Unlike federal loans, private loans tend to have fewer repayment options and protections, which can be a disadvantage for struggling borrowers. They may also lack the benefits associated with federal loans, such as income-driven repayment plans.

- Federal student loans generally have lower interest rates than private loans

- Federal loans offer various repayment plans and loan forgiveness options

- Private loans may have higher interest rates and less favorable terms

- Borrowers should evaluate their eligibility for federal loans before considering private options

Choosing between federal and private loans is a significant decision that can affect your financial stability for years to come. It’s important to weigh the pros and cons and select the option that best meets your educational and financial needs.

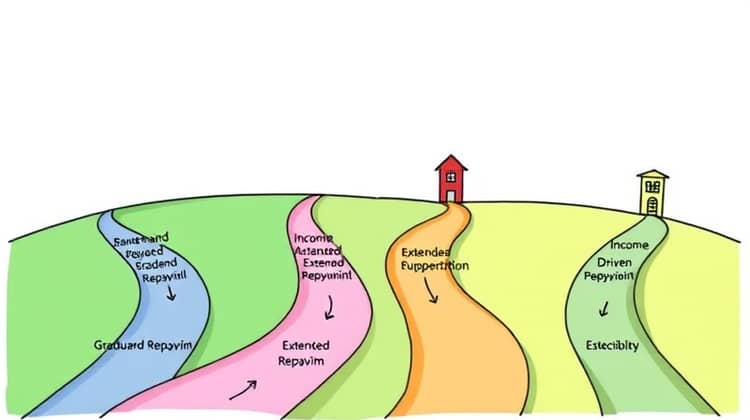

Federal Student Loan Repayment Plans

When it comes to repaying federal student loans, borrowers have several repayment plans to choose from. These plans are designed to accommodate different financial situations and help borrowers manage their payments. Understanding these options is essential for navigating student debt effectively.

The main federal student loan repayment plans include Standard Repayment, Graduated Repayment, Extended Repayment, and Income-Driven Repayment plans, each with unique structures and eligibility criteria. As you consider your repayment options, it's important to review each plan’s specifics according to your financial circumstances.

1. Standard Repayment Plan

The Standard Repayment Plan is the default repayment option for federal student loans. Under this plan, borrowers typically make fixed monthly payments over a 10-year term. This plan is straightforward and allows borrowers to pay off their loans relatively quickly, minimizing the amount of interest accrued over time.

One of the key benefits of the Standard Repayment Plan is its predictability. With fixed payments, borrowers can budget effectively, and they often pay less interest compared to other repayment options if they stick to the plan. However, this plan may not be suitable for those with lower incomes or other financial obligations, as the monthly payments are higher than those in income-driven repayment plans.

2. Graduated Repayment Plan

The Graduated Repayment Plan allows borrowers to start with lower monthly payments that gradually increase over time, typically every two years. This plan is designed for those who expect their income to rise significantly after they graduate. The repayment term is still set at 10 years, similar to the Standard Plan.

A significant advantage of the Graduated Repayment Plan is that it accommodates borrowers who may struggle with higher payments early in their careers but anticipate increased earning potential in the future. This flexibility can provide immediate relief, but borrowers should be aware that they may pay more interest overall over the life of the loan compared to the Standard Repayment Plan.

However, the potential drawbacks include the possibility of increasing financial pressure as monthly payments rise, which may become burdensome if income does not increase as expected. Borrowers are encouraged to plan their finances carefully to ensure they can meet escalating payments.

3. Extended Repayment Plan

The Extended Repayment Plan allows borrowers to extend their payment term up to 25 years, which can significantly lower monthly payments. This option is ideal for borrowers with large amounts of student loan debt who need smaller payments to manage their financial obligations effectively.

While extending the repayment term can make monthly payments more manageable, it’s important to note that borrowers will pay more in interest over the life of the loan. Therefore, individuals considering this option must weigh the benefits of lower payments now against the potential long-term financial impact. Also, only borrowers with more than $30,000 in federal Direct Loans or FFEL Program loans are eligible for this plan.

4. Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans are tailored to accommodate borrowers whose incomes are modest or inconsistent. These plans adjust monthly payments based on the borrower’s income and family size, making them an appealing option for those working in lower-paying jobs or experiencing financial difficulties.

The primary types of IDR plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). While each has its specific eligibility requirements and payment structures, they all aim to make student loan repayment more manageable based on a borrower's income.

- You may qualify for $0 monthly payments if your income is low enough

- After 20 or 25 years of qualifying payments, you may be eligible for loan forgiveness

- These plans can help avoid default and provide financial flexibility

Deciding on an IDR plan can offer significant advantages if you're struggling to keep up with payments. However, it's crucial to understand the specific requirements and how they will affect your long-term repayment.

5. Income-Based Repayment Plan (IBR)

The Income-Based Repayment Plan (IBR) caps monthly payments at 10-15% of your discretionary income, depending on when you borrowed your loans. Borrowers may qualify for $0 payments if their income is low enough, providing immediate financial relief during challenging times.

To remain enrolled in IBR, borrowers must recertify their income and family size every year. This annual review ensures that payments remain manageable in light of any changes in financial circumstances. A significant benefit of IBR is that after making qualifying payments for 20 or 25 years, any remaining loan balance may be eligible for forgiveness.

6. Pay As You Earn (PAYE) and Revised Pay As You Earn (REPAYE)

PAYE and REPAYE are two types of income-driven repayment plans that similarly aim to keep payments affordable. PAYE caps payments at 10% of discretionary income and offers forgiveness after 20 years of qualifying payments, similar to IBR, but has slightly stricter eligibility requirements.

REPAYE, on the other hand, is available to more borrowers, regardless of when they took out their loans. This plan also caps payments at 10% of discretionary income, but the timeline for forgiveness is extended to 20 years for undergraduate loans and 25 years for graduate loans. Additionally, REPAYE provides interest subsidies to help manage accruing interest, making it a beneficial option for many borrowers.

7. Income-Contingent Repayment Plan (ICR)

The Income-Contingent Repayment Plan (ICR) is unique among income-driven plans because it allows borrowers to pay the lesser of 20% of their discretionary income or what they would pay on a fixed payment plan over 12 years (adjusted for income). This plan is available to all borrowers with federal Direct Loans, making it a flexible option for various financial situations.

ICR requires annual recertification of income and family size and offers borrowers a path to forgiveness after 25 years of qualifying payments. However, because payments can fluctuate based on income, borrowers should be prepared for potential changes in monthly obligations.

- 20% of discretionary income or a fixed payment plan, whichever is less

- Requires recertification annually for income and family size

- Forgiveness available after 25 years of qualifying payments

ICR can be an excellent option for those whose income may vary significantly, but it's essential to anticipate potential changes in repayment amounts. Borrowers should weigh these factors carefully when choosing their repayment strategy.

Loan Forgiveness Programs

For borrowers facing significant financial pressure, loan forgiveness programs can provide much-needed relief. These programs are designed to forgive some or all of a borrower's federal student loans after meeting specific criteria, making it an attractive option for those in eligible professions or circumstances.

The three primary loan forgiveness programs available to federal loan borrowers are Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Perkins Loan Cancellation. Each program has distinct eligibility requirements and forgiveness criteria, so it's crucial to understand which option may be right for you.

1. Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program is designed for borrowers who work in qualifying public service jobs, including positions in government, non-profits, and certain other organizations. To qualify for PSLF, borrowers must make 120 qualifying monthly payments under a qualifying repayment plan while employed full-time in a public service role.

One of the most significant benefits of PSLF is its potential for total loan forgiveness after 10 years of payments. This program offers substantial financial relief for those dedicated to public service, allowing borrowers to focus more on their careers and less on debt. However, it can be challenging to navigate the specific requirements and ensure all paperwork is in order, making diligence a necessity for participants.

Qualifications can change, and applying for PSLF can be complicated, so students should track their employment and ensure they are making qualifying payments. Staying informed about the program's requirements will be critical to successfully achieving loan forgiveness under PSLF.

2. Teacher Loan Forgiveness

Teacher Loan Forgiveness is another valuable program designed to reward educators for their commitment to teaching in low-income schools. To qualify, teachers must work full-time for five consecutive years at a qualifying school and can receive up to $17,500 in loan forgiveness, depending on their teaching field and subject matter expertise.

This program reflects the government's commitment to addressing teacher shortages in critical areas like math, science, and special education. By incentivizing educators to teach in underserved areas, the program aims to ensure students receive quality education even in economically disadvantaged communities.

3. Perkins Loan Cancellation and Discharge

Perkins Loan Cancellation and Discharge programs offer forgiveness options for borrowers with Perkins Loans who enter specific professions or circumstances. For example, those who work in teaching, nursing, or law enforcement may qualify for full or partial cancellation of their Perkins Loans after completing certain service requirements.

Eligibility requirements vary depending on the specific profession, so borrowers should review the criteria carefully. This program serves as an additional layer of support for borrowers who have dedicated their careers to serving communities or working in essential job roles.

Consolidation and Refinancing

Borrowers may face challenges managing multiple loans, leading many to consider consolidation or refinancing options. While both strategies aim to simplify repayment, they function differently and have distinct benefits and drawbacks. Understanding these processes is essential for making informed financial decisions and choosing the best path forward.

Loan consolidation involves combining multiple federal student loans into a single loan with a weighted average interest rate. This option simplifies repayment by combining multiple payments into one, but borrowers should be aware that consolidating federal loans can result in losing certain benefits, such as borrower protections and forgiveness eligibility.

1. Loan Consolidation

The Direct Consolidation Loan allows federal student borrowers to consolidate their loans into a single new loan. Borrowers benefit from a simpler payment process, as they will only need to manage one payment each month. Additionally, consolidation can help manage payments more effectively, especially for those with varying interest rates or repayment plans.

However, borrowers must be cautious, as consolidating federal loans may result in losing certain benefits. For example, if a borrower consolidates loans that were eligible for forgiveness, they may lose those benefits under the new loan. Therefore, it’s essential to weigh the pros and cons before deciding to consolidate loans.

2. Refinancing

Refinancing involves obtaining a new loan, typically from a private lender, to pay off existing federal or private student loans. This process can potentially result in lower interest rates and reduced monthly payments. Refinancing is particularly beneficial for borrowers with strong credit histories who may qualify for better terms than those offered on federal loans.

While refinancing can be advantageous, it’s important to recognize that borrowers who refinance federal loans will lose certain protections and benefits associated with federal loans, including access to income-driven repayment plans and loan forgiveness opportunities. This is a critical consideration that borrowers need to weigh before proceeding with refinancing.

Making a Choice

Navigating student loan repayment options requires a careful assessment of individual financial circumstances, career goals, and the potential long-term repercussions of various choices. Choosing the right repayment plan or loan option can significantly affect a borrower's financial stability and quality of life.

It is essential to review all options thoroughly, considering factors such as income, job stability, and long-term financial goals. Borrowers should also seek advice from financial professionals when needed to create a strategy that aligns with their unique situation. Understanding eligibility requirements and potential outcomes will empower students to make informed choices about their student loans during repayment.

By taking the time to research and evaluate repayment options, borrowers can find the best path forward to manage their student loan debt effectively. Staying informed about changes in student loan policies and available resources can also enhance their decision-making process.

Conclusion

Student loan repayment is a critical financial aspect that affects millions of borrowers. Understanding the differences between federal and private loans, as well as repayment plans, forgiveness programs, and consolidation options, is vital for navigating the financial landscape of education debt.

The right repayment choice can help borrowers manage their debt effectively, stay on top of payments, and work toward eventual forgiveness when applicable. Each borrower's situation is unique, and it's crucial to tailor decisions to meet personal and financial goals.

Through thorough research and planning, borrowers can make educated choices that lead to a stable financial future despite the challenges that student loans may present. Taking proactive steps in repayment can turn an overwhelming burden into a manageable part of achieving one's educational and career aspirations.