In today's financial landscape, understanding the implications of credit card age is crucial for individuals keen on building and maintaining a good credit score. Credit cards are not just financial tools; they also play a significant role in determining your creditworthiness. A robust credit score is essential for various financial opportunities, including loans, mortgages, and even job applications.

The age of your credit card portfolio refers to the length of time your credit accounts have been active. This aspect of your credit history is pivotal, as it contributes to about 15% of your overall credit score under FICO scoring models. A longer credit history can signify to lenders that you are financially responsible and capable of managing credit effectively.

As such, cultivating a thoughtful approach to credit card usage and management is vital. This article will delve into various facets of credit card age, its impact on your credit score, and strategies to enhance your credit profile. Let's explore the nuances of credit card age and how you can harness them to boost your financial standing.

Defining Credit Card Age

Credit card age is a measure of how long you’ve had your credit cards active. This metric is not only about the individual age of each card but also the average age of all your credit accounts. Lenders and credit scoring agencies consider longer account histories as an indicator of reliability and low-risk behavior.

When you open a new credit card, the account's age reflects your credit history from that moment. Consequently, new accounts can lower your average credit age, which may affect your credit score negatively, particularly if you open multiple new accounts in a short period. This is why it's often advised to maintain longer-standing accounts without closing them, as they contribute positively over time.

Managing credit responsibly involves not only strategic financial decisions but also an awareness of how each card's age contributes to your overall credit profile. Understanding this concept is the first step in using credit cards effectively to boost your financial health.

- Credit Card Age Definition: The total time since you opened your first credit card account.

- Average Age of Accounts: This is the sum of each account's age divided by the number of accounts.

- Impact on Credit Score: Longer card age generally leads to higher credit scores, indicating reliability.

In summary, knowing how to assess credit card age will help you manage your accounts efficiently. By being aware of your card details, you can make informed decisions that contribute positively to your credit profile.

As we proceed, we will discuss the direct effects of credit card age on your credit score, followed by practical methods to maintain and improve it.

How Credit Card Age Affects Your Credit Score

Credit scoring is an intricate system that weighs various factors, and credit card age holds a considerable influence. As mentioned earlier, it contributes up to 15% to your overall FICO score. This segment of your score reflects the reliability and experience that comes with a longer credit history.

Lenders prefer individuals with lengthy credit histories as it helps them gauge your ability to manage credit effectively. A consistent record of timely payments over the years exemplifies responsible credit management, making you a more attractive candidate for loans or credit lines.

Conversely, a younger credit profile can result in a lower credit score. If you've recently opened multiple accounts or just started building credit, lenders may perceive you as a higher risk, diminishing your chances of securing favorable terms on credit products.

Thus, it becomes essential to understand the balance between building new credit without compromising your existing accounts and their age.

Calculating the Age of Your Credit Cards

Understanding how to calculate the age of your credit cards is essential for improving your credit score. The age refers not only to the individual account but also the average age of all your credit accounts. Knowing these details allows you to make informed decisions about your credit management.

To calculate the average age of your credit cards, you will take the age of each card and divide it by the number of your credit accounts. This average is crucial as it reflects your credit history and influences your credit score significantly.

- List all your credit cards with their respective opening dates.

- Determine the current age of each card by subtracting the opening date from today’s date.

- Calculate the average age by summing the ages of all accounts and dividing by the total number of accounts.

Regular updates to your credit report, along with periodic monitoring of your credit accounts, can aid in tracking your credit age effectively. This hands-on approach will empower you to make better financial decisions.

In the subsequent section, we will explore the oldest credit card rule and how it can impact your credit score.

The Oldest Credit Card Rule

The 'Oldest Credit Card Rule' states that your credit score will benefit from keeping your oldest credit card open, regardless of how rarely you use it. This is because the length of your credit history is a significant factor in credit scoring models.

When you close an older account, you effectively reduce the average age of your credit accounts, which could lead to a decrease in your credit score. The impact can be particularly pronounced if you don't have many other credit accounts to offset the reduction.

Therefore, if you’re contemplating closing an account due to inactivity or an annual fee, it might be wiser to consider the long-term ramifications on your credit score and opt for alternatives, such as using the card occasionally to keep it active.

- Keep your oldest credit card open, even if it has a low or no balance.

- Use your old credit card periodically to maintain activity.

- Avoid closing accounts unless absolutely necessary, as it can harm your credit age.

Maintaining older cards can be challenging, especially if they come with fees or are rarely used. However, the potential impact on your credit score makes it a worthwhile consideration.

In the next section, we will discuss strategies to enhance not only your credit card age but also your overall credit score.

This holistic approach will guide you in creating a robust credit profile that supports your financial goals.

Strategies to Improve Credit Card Age and Overall Credit Score

Improving your credit card age requires strategic decisions regarding your credit usage. Here are some practical ways to achieve that goal and simultaneously improve your overall credit score.

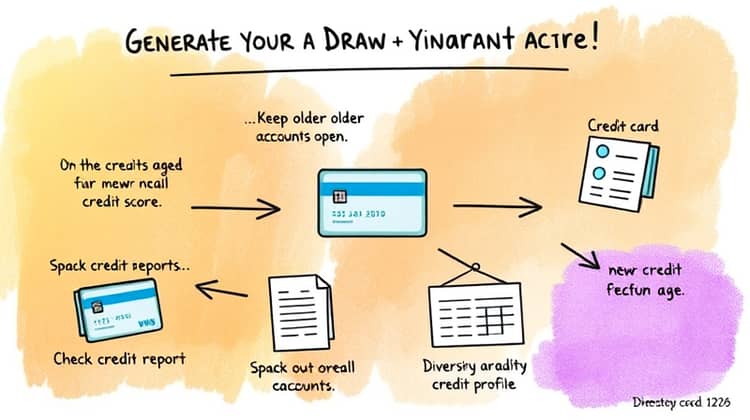

First, focus on keeping your older accounts open, as explained earlier. Secondly, ensure that any new credit applications are spaced out over time to avoid negative impacts on your credit age.

- Regularly check your credit report for errors and resolve discrepancies.

- Consider becoming an authorized user on a responsible person's credit card to benefit from their account age.

- Use a mix of credit types (credit cards, installment loans) to diversify your credit profile.

Implementing these strategies will not only sustain but also enhance your credit card age, which is vital for a robust credit score. Consistent monitoring and management of your credit accounts are equally important to track your progress effectively.

This credit maintenance offers insights into areas where you may need improvement, ensuring you stay focused on your financial goals.

Common Mistakes to Avoid

Avoiding common pitfalls is essential in maintaining a healthy credit card age. Many individuals mistakenly close old credit card accounts believing it will help streamline their finances, negatively impacting their credit score instead.

Another frequent mistake is opening multiple new accounts within a short timeframe. This kind of behavior can lower your average credit age and raise red flags for lenders.

- Don't close old accounts to avoid annual fees.

- Resist the urge to open multiple new accounts at once.

- Make timely payments to ensure your credit health remains intact.

By steering clear of these mistakes, you can protect your credit card age and, by extension, your credit score. Proactive management and awareness are key in credit card strategies.

Ultimately, consistent and smart usage of credit cards can lead to a healthier credit profile, enabling you to achieve your financial aspirations successfully.

Additional Factors Contributing to Credit Card Age

In addition to account age, several other factors influence your credit card age and overall credit profile. Understanding these facets is pivotal for effective credit management and score enhancement.

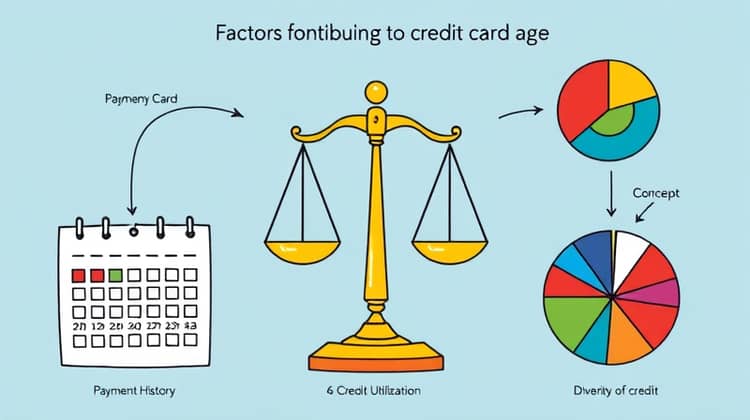

One such factor is your payment history; it plays a crucial role in determining creditworthiness. Making timely payments can counterbalance the negative effects of a shorter credit age, thus improving your overall score over time.

- Payment history: Consistent and timely payments positively impact your score.

- Credit utilization: Maintain low balances relative to your credit limits.

- Diversity of credit: A well-rounded credit profile with various account types enhances scores.

Recognizing these contributing factors allows you to develop a comprehensive approach to your credit strategy. This overview will keep you informed and in control of your credit management practices.

With this knowledge, we now move to the concluding thoughts on the impact of credit card age and your credit score.

Conclusion

In conclusion, credit card age is a vital aspect of your overall credit score that requires diligent attention and management. By nurturing your credit accounts appropriately, you can enhance your credit age and, in turn, boost your credit score opening up wider financial opportunities.

Moreover, staying informed about the common mistakes and strategic practices can empower you to take control of your credit health. Building credit wisely is a journey requiring patience and informed choices, but the rewards can be substantial.

Lastly, remember that a healthy credit profile is not built overnight; it is the result of consistent efforts over time. Maintain a proactive approach, and you will likely see favorable results.