A 401(k) plan is a powerful tool for building retirement savings, offering individuals a tax-advantaged way to save for the future. Understanding how these plans work, their benefits, and how to utilize them effectively is crucial for anyone looking to secure their financial future. This guide will walk you through the essentials of 401(k) plans, including types, contribution limits, tax advantages, and how to start investing in one.

With the rising costs of living and the unpredictability of social security, it's more important than ever to take charge of your retirement savings. A 401(k) not only helps you save but often comes with employer contributions that can significantly boost your savings over time. By taking advantage of these plans, you can ensure that you'll have a comfortable retirement.

Whether you're just starting your career or are nearing retirement, understanding 401(k) plans can empower you to make informed decisions about your financial future. Let's dive deeper into what a 401(k) plan is and how it can benefit you.

What is a 401(k) Plan?

A 401(k) plan is a retirement savings plan sponsored by an employer that allows employees to save a portion of their paycheck before taxes are taken out. This means that contributions made to the plan reduce an employee's taxable income for the year, which can lead to significant tax savings.

The funds in a 401(k) plan can be invested in a variety of assets, including stocks, bonds, and mutual funds. This investment growth is tax-deferred, meaning you won’t owe taxes on the earnings until you withdraw them during retirement, when you may be in a lower tax bracket.

In addition to employee contributions, many employers will offer matching contributions, where they match a portion of the employee's contributions to encourage saving. This is essentially free money that boosts retirement savings.

The 401(k) plan is named after a section of the Internal Revenue Code that governs these retirement plans, making them a widely recognized and standardized option for retirement savings in the United States.

How Does a 401(k) Work?

Employees can decide how much of their salary they want to contribute to their 401(k) plans, up to a specified limit set by the IRS. These contributions are deducted from the employee's paycheck before taxes, which means they can reduce taxable income and save on taxes up front.

Employers may offer a variety of investment options within the 401(k) plan, allowing employees to choose how to allocate their contributions. This flexibility enables employees to customize their investments based on their risk tolerance and retirement timeline.

In most cases, employees cannot withdraw funds from their 401(k) accounts until they reach retirement age, which is generally 59½ years old. However, there are certain circumstances, such as financial hardship or the purchase of a first home, where early withdrawals may be permitted, though penalties and taxes may apply.

Upon reaching retirement, employees can begin to withdraw funds from their 401(k) accounts, either through lump-sum withdrawals, structured distributions, or the purchase of an annuity. It's important to have a plan for withdrawals to manage taxes and sustain income during retirement.

Types of 401(k) Plans

There are several types of 401(k) plans available to employees, each with its own features. The two most common types are the traditional 401(k) and the Roth 401(k). In a traditional 401(k), contributions are made with pre-tax dollars, and taxes are paid upon withdrawal in retirement.

On the other hand, a Roth 401(k) allows employees to contribute post-tax income, meaning withdrawals during retirement are generally tax-free. This can be a valuable option for those who expect to be in a higher tax bracket when they retire.

It's also worth noting that there are other variations of 401(k) plans, such as solo 401(k) plans for self-employed individuals and safe harbor 401(k) plans designed to simplify compliance with non-discrimination requirements, making it easier for employers to offer these plans to employees.

- Traditional 401(k)

- Roth 401(k)

- Safe Harbor 401(k)

- Solo 401(k)

Understanding the different types of 401(k) plans can help you determine which options are best suited for your financial goals and retirement strategy. It's essential to review these options when deciding where to invest your retirement savings.

Why Invest in a 401(k)?

Investing in a 401(k) plan is a critical step toward achieving financial independence in retirement. With the unique tax advantages and potential for employer matching, these plans can significantly impact your long-term savings strategy.

- Tax-deferred growth of investments

- Potential employer matching contributions

- Reduced taxable income

- Financial security in retirement

By taking advantage of these benefits, individuals can build a more robust retirement portfolio, making it easier to achieve their retirement goals.

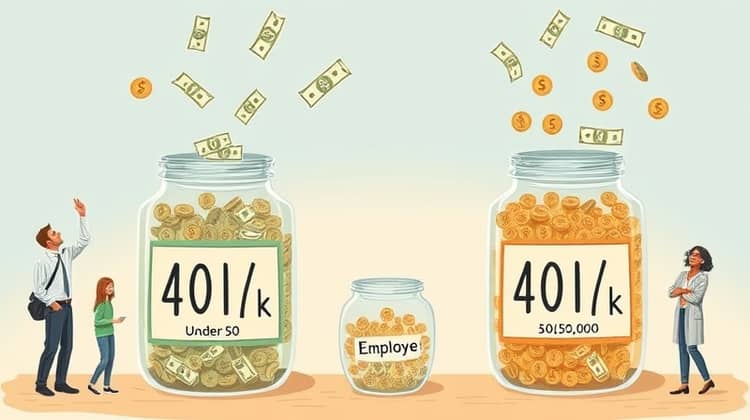

Contribution Limits

As of 2023, the IRS has set contribution limits for 401(k) plans to promote consistent savings while also discouraging excessively high contributions. For employees under 50 years of age, the contribution limit is $22,500, while those aged 50 and above can contribute an additional $7,500 as a catch-up contribution.

These limits are indexed for inflation, meaning they are typically adjusted each year, which provides individuals with an opportunity to increase their contributions over time to keep up with rising living costs. It's important for savers to stay informed about these limits to ensure they're maximizing their retirement savings.

Employers may also contribute to the plan, and if they choose to match contributions, this effectively increases the total amount being saved for retirement. However, combined contributions (employee plus employer) cannot exceed the annual limit set by the IRS.

Employer Matching

One of the most enticing features of many 401(k) plans is the employer matching contribution. This is where an employer matches a portion of the employee’s contributions to their 401(k), providing additional funds to the employee’s retirement savings. Such matches can substantially enhance the employee’s overall retirement savings.

Typically, the employer match is expressed as a percentage of the employee's contribution, up to a certain limit. For example, an employer might offer a 50% match on employee contributions, up to the first 6% of pay. This means that if an employee contributes 6% of their salary, the employer adds an additional 3%.

Maximizing the employer match should be a priority for employees, as it is essentially free money that boosts retirement savings without impacting the employee’s net pay.

Tax Advantages

One of the primary benefits of a 401(k) plan is the significant tax advantages it offers to participants. Contributions made to a traditional 401(k) are tax-deductible, reducing your taxable income for the year you make the contribution.

Additionally, the investments within the 401(k) can grow tax-deferred. This means that any dividends, interest, or capital gains that are earned in the account won’t be taxed until withdrawn, potentially allowing for greater accumulation of wealth over time.

For those with a Roth 401(k), while you pay taxes on your contributions upfront, the withdrawals made during retirement are tax-free, providing an alternative tax strategy for certain individuals.

Overall, these tax advantages can lead to a more significant retirement fund, especially for those who consistently contribute and take full advantage of their 401(k) plans.

Vesting

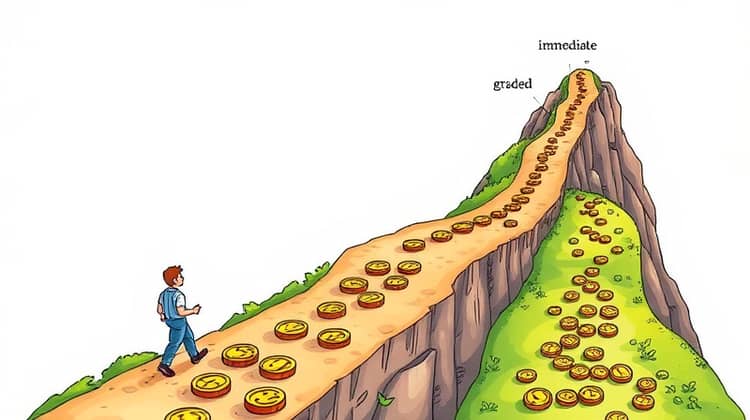

Vesting refers to the time period required for an employee to have full ownership of the contributions their employer has made to their 401(k) plan. While employees always own their contributions, employer contributions typically have a vesting schedule that must be met before employees can claim these funds.

Vesting schedules can vary widely among plans and may be immediate, graded (where employees earn a percentage of the contributions over time), or cliff (where employees gain full rights to the contributions after a specific period).

- Immediate vesting

- Graded vesting

- Cliff vesting

Understanding your plan’s vesting schedule is crucial, particularly if you are considering changing jobs. Unvested employer contributions may be lost if you leave before meeting the vesting requirements.

Investment Options

401(k) plans typically offer a range of investment options to participants, enabling them to create a diversified portfolio that aligns with their risk tolerance and investment goals. Common investment choices include mutual funds, stocks, bonds, and target-date funds.

Additionally, many plans offer a selection of company stock, which can be a way to invest directly in the employer's future performance. However, it's essential to avoid concentrating too much of your retirement savings in a single asset type.

- Mutual Funds

- Individual Stocks

- Bonds

- Target-Date Funds

When selecting investments within your 401(k), it's advisable to assess your overall financial situation, investment timeline, and personal risk tolerance to make informed choices.

Risks

Investing through a 401(k) plan is not without risks. The primary concern for many investors is market risk, as the value of the investments can fluctuate based on market conditions.

Another risk to consider is that if you have limited investment options within your plan, you might not be able to adequately diversify your portfolio, potentially leading to greater exposure to market swings.

- Market Risk

- Limited Investment Choices

- Fee Structure

Understanding these risks is essential for managing your 401(k) effectively and ensuring that your portfolio remains aligned with your retirement goals.

How to Get Started

Starting a 401(k) plan involves enrolling in your employer’s offered plan and deciding how much to contribute from your paycheck. It's a straightforward process, typically handled through human resources or your employer's benefits department.

Before enrolling, take the time to review all available investment options, contribution limits, and any employer matching options to create a solid savings strategy.

- Speak with your HR or benefits administrator

- Review the investment options available

- Decide on your contribution amount

- Enroll in the 401(k) plan

Taking these steps will help you to start your journey toward building a secure financial future through consistent retirement savings.

Conclusion

Understanding how a 401(k) plan works and the benefits it provides is essential for anyone looking to plan for a secure retirement. By taking advantage of tax benefits, employer matching, and investment options, individuals can significantly enhance their retirement savings.

Start early, contribute consistently, and take the time to educate yourself on how to maximize your 401(k) to pave the way for a comfortable retirement.