Credit card insurance is an often-overlooked aspect of personal finance that can provide critical protection for cardholders. In today’s world, where financial uncertainties are prevalent, being secure and informed about the options available through credit cards is paramount. This article delves into the various benefits associated with credit card insurance, how to access these benefits, and the importance of understanding the limitations that apply. By the end of this guide, you should have a comprehensive understanding of credit card insurance and its relevance in your financial planning.

1. What is Credit Card Insurance?

Credit card insurance is a policy that covers certain risks associated with using a credit card. This type of insurance can protect consumers from unforeseen circumstances that may hinder their ability to pay off their credit card balance. Various credit card issuers provide this insurance as part of their service offerings or as an optional add-on feature, giving cardholders peace of mind.

Common elements covered by credit card insurance include job loss, disability, and even death. When one of these unfortunate events occurs, the insurance can help cover the outstanding debt, providing financial relief during stressful times. In addition, some insurance plans may cover fraudulent transactions, offering protection against identity theft.

Understanding the specifics of credit card insurance is critical. Not all credit card insurance plans are created equal; the terms, coverage amounts, and exclusions can vary widely among providers. Cardholders should familiarize themselves with their policy details to maximize their benefits.

2. Types of Credit Card Insurance Benefits

Credit card insurance can come in various forms, each designed to address specific risks that cardholders might face. Here are some common types of benefits included in credit card insurance plans.

- Loss of Job Coverage

- Disability Coverage

- Life Insurance Coverage

- Fraud Protection Coverage

- Purchase Protection Coverage

Each of these benefits serves a unique purpose, ensuring that cardholders are protected against risks that can impact their finances during emergencies. Cardholders should carefully evaluate what options are available and choose those that align with their personal risk tolerance.

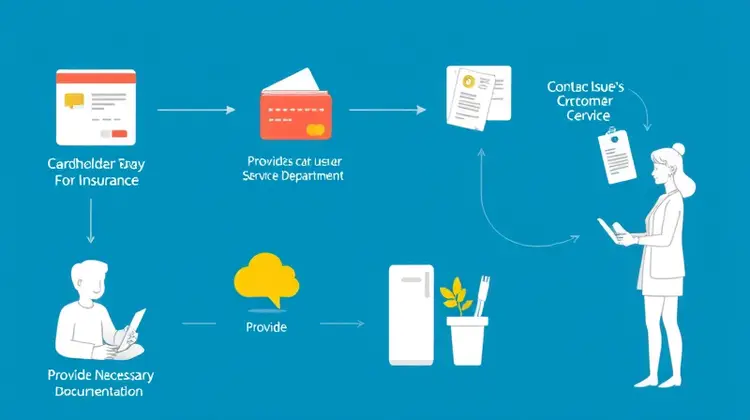

3. How to Access These Benefits

Accessing credit card insurance benefits typically involves a straightforward process, but it may vary depending on the insurer and the specific policy in question. First, cardholders need to ensure that they have signed up for the insurance coverage at the time of obtaining the credit card. While some credit cards automatically include certain types of insurance, others may require an opt-in.

Once coverage is confirmed, utilizing the benefits often involves contacting the credit card issuer’s customer service department. Cardholders should be prepared to provide necessary documentation, such as proof of income loss or medical notifications, to file a claim successfully.

It is important to act swiftly when trying to utilize these benefits, as many plans have strict timeframes within which a claim must be filed after the triggering event. Familiarizing oneself with these procedures can make a significant difference in successfully accessing the insurance benefits.

4. Limitations and Exclusions

While credit card insurance can offer valuable protection, it does come with certain limitations and exclusions that cardholders should be aware of. For instance, many credit card insurance policies do not cover pre-existing conditions, so if a cardholder has a known health issue leading to disability, they might not be eligible for assistance.

Additionally, there may be limits on the total amount that can be covered, and certain types of losses (such as self-inflicted injuries or loss due to criminal activity) may also be excluded. It is crucial for cardholders to read the fine print carefully to understand what is and isn't covered under their specific policy.

5. Why Credit Card Insurance is Important

Credit card insurance holds significant importance in today’s unpredictable financial landscape. Many individuals find themselves in precarious situations due to unforeseen job losses, medical emergencies, or even identity theft. Having access to insurance benefits can alleviate the burden of significant financial strain, allowing individuals to recover and regain their footing without the added pressure of unpaid debt.

Moreover, credit card insurance can serve as an essential safety net that provides peace of mind for cardholders. Knowing that if something goes wrong, there is a plan in place to help manage outstanding balances can lead to more responsible credit card usage. This, in turn, can encourage healthier financial behaviors, preventing cycles of debt that are difficult to escape.

Ultimately, as part of a complete financial strategy, credit card insurance can protect not only the user’s credit score but also their overall financial health. It encourages individuals to invest in their welfare and consider insurance options as a fundamental aspect of financial literacy.

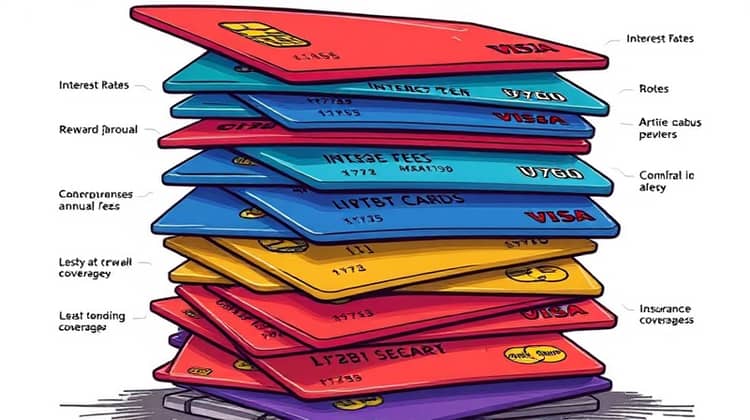

6. Comparing Different Credit Cards

When selecting a credit card, it is essential to compare the insurance benefits provided by different credit cards. Some credit cards offer robust insurance policies with extensive coverage options, whereas others might have more limited benefits that do not fully meet individual needs. It is also worth considering how the costs associated with these insurance plans fit into the broader picture of card usage and overall financial planning.

Furthermore, cardholders should evaluate the overall terms of each credit card, weighing factors like interest rates, annual fees, reward programs, and insurance coverage to choose the best option tailored to their needs. Comparing these elements will empower consumers when making informed decisions about credit card use and insurance coverage.

7. Real-Life Scenarios

Understanding how credit card insurance benefits can play out in real-life scenarios can highlight their importance significantly.

- A sudden job loss leading to financial difficulties, with insurance covering the balance.

- Medical emergencies resulting in unplanned expenses that are mitigated by insurance.

- Fraudulent transactions that are reimbursed through card insurance.

These examples illustrate how having insurance can make a substantial difference in a person's financial and emotional well-being during challenging times. By considering potential scenarios, cardholders can appreciate the value of credit card insurance even more.

8. Conclusion

In conclusion, credit card insurance offers valuable protection against various financial risks that can arise unexpectedly. It is crucial to understand the types of coverage available, how to access these benefits, and any inherent limitations that come with them. As financial situations can change rapidly, having insurance can cushion the impact during difficult times and provide a sense of security.

Moreover, with careful consideration and comparison of different credit card offerings, individuals can find the right balance of benefits to match their specific needs. As more consumers become aware of the importance of credit card insurance, they can utilize it to enhance their overall financial strategies.

Ultimately, credit card insurance is not just an additional expense but an integral part of being responsible with credit and preparing for life’s unforeseen events.