Navigating the world of credit cards can be daunting, especially when it comes to understanding the terms and conditions associated with them. These documents formulate the basis of your agreement with the issuer, detailing your responsibilities and their obligations. Without comprehending these terms, you could inadvertently incur costly fees or miss out on benefits that a well-informed consumer could take advantage of.

This article aims to dissect the various terms and conditions commonly found in credit card agreements. By breaking them down into their essential components, we'll provide you with a clearer understanding, enabling you to make informed choices. Understanding these terms is not merely about reading; it’s about being proactive in managing your finances and making personal finance decisions that align with your lifestyle and goals.

Why It’s Important

Understanding credit card terms and conditions is crucial for any consumer intending to use credit wisely. Many people are drawn to credit cards due to their perks and convenience, but failing to grasp the associated terms can lead to significant financial burdens. By knowing what to look out for, you can prevent pitfalls and harness the rewards of your credit card effectively.

Moreover, many consumers overlook the fine print when signing up for a credit card. Some may find themselves surprised later when they receive bills laden with fees or interest rates that they weren't expecting. Therefore, it is essential to not only read but also comprehend these documents, as they can significantly impact your credit score and financial health.

- Prevents unexpected fees and charges

- Helps manage credit utilization effectively

- Enables better financial planning

- Maximizes rewards and benefits

In essence, understanding these terms is about becoming a savvy consumer. By being informed and aware, you arm yourself with the knowledge necessary to utilize credit cards more judiciously.

Key Terms and Conditions to Look Out For

There are several crucial terms to pay attention to when reviewing credit card contracts. Each of these terms has the potential to impact your financial situation significantly, so it’s wise to understand them before committing to a card. These terms are not typically highlighted but are critical in determining your credit card's advantages and disadvantages.

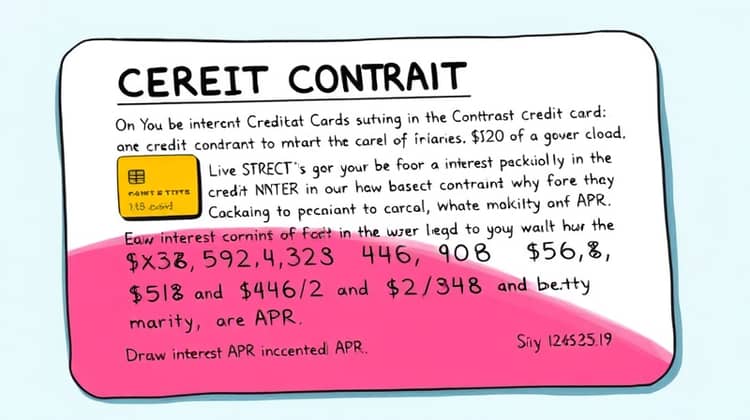

1. Interest Rates and APR

Interest rates, expressed as Annual Percentage Rate (APR), are fundamental to understanding credit card costs. The APR directly affects how much you'll pay if you carry a balance from month to month. A higher APR can lead to substantial interest charges, making it crucial to pay off your balance in full each month if possible.

Moreover, credit cards often have multiple APRs, including a standard purchase APR, a cash advance APR, and a penalty APR for late payments. Each of these rates can differ significantly, which can catch consumers off guard if they're not vigilant.

It's advisable to compare the APRs of different credit cards before making a choice, as a lower APR can save you money in interest over time. Always factor in your spending habits and the likelihood of carrying a balance, as this can inform which credit card might suit you best.

Finally, paying attention to how interest is calculated can also prove beneficial. Usually, interest is accrued daily based on the average daily balance, so understanding this calculation can help you strategize your payments, helping you avoid extra charges.

2. Annual Fee

An annual fee is a charge that some credit card issuers apply every year simply for holding the card. While some cards come with no annual fee, others, especially those with premium rewards, can charge significant amounts. Hence, it's crucial to evaluate whether the rewards offered compensate for this fee.

When considering a credit card with an annual fee, do a cost-benefit analysis. If the benefits, such as cashback, travel rewards, or insurance protections, exceed the fee, it might be worth it. In some cases, issuers may waive the fee for the first year, but you'll want to ensure it remains a benefit in subsequent years.

Additionally, if you find yourself not utilizing the perks sufficiently, you may want to reconsider or switch to a no-annual-fee card. An informed decision can save you from unnecessary expenses.

Ultimately, understanding annual fees is key to evaluating whether a credit card aligns with your financial health and lifestyle.

3. Late Payment Fees

Late payment fees occur when you fail to make at least the minimum payment by the due date. Most credit card issuers impose this fee, which can range from $25 to $40. Repeatedly incurring late fees can also contribute to a higher APR through penalty rates, adding more financial strain.

Additionally, late payments can negatively impact your credit score. Credit scores are calculated based on various factors, and payment history is one of the most significant. A single late payment could stay on your credit report for years, demonstrating the long-lasting impact of late fees beyond their immediate cost.

Being aware of due dates and setting reminders can serve as a simple yet effective strategy for avoiding late fees altogether.

4. Balance Transfer Fees

Balance transfer fees are charged when you move debt from one credit card to another. Often, issuers will advertise introductory 0% APR offers on balance transfers to attract customers, but they typically charge a fee of around 3% to 5% of the amount transferred.

While balance transfers can be an effective strategy to pay off high-interest debt more efficiently, it's essential to calculate whether the fee offsets the savings you gain from the interest rate reduction.

5. Foreign Transaction Fees

Foreign transaction fees are charges incurred when you make purchases in a foreign currency or through a foreign bank. These fees can range from 1% to 3% of the purchase price, and while they may seem minor, they can add up quickly when traveling abroad.

To avoid these costs, you may want to consider credit cards that do not charge foreign transaction fees, especially if you travel frequently. Utilizing a card that offers this benefit can help maximize your spending power while overseas.

- 1% to 3% charges per transaction

- Add up quickly for frequent travelers

- Best to look for no-foreign transaction fee cards

Ultimately, knowledge about foreign transaction fees helps you choose the best credit product before you travel.

6. Grace Period

A grace period is the time frame in which you can pay your balance in full before incurring interest on new purchases. Typically, this period lasts from the end of your billing cycle until your payment due date, usually ranging from 21 to 25 days.

Understanding your card's grace period can lead to potential savings, as you can avoid interest charges entirely by paying off your statement balance before the due date. It also allows you to manage your cash flow better by providing a buffer period for your payments.

Not all transactions have grace periods. Purchases made during a billing cycle after a balance is rolled over often incur immediate interest, so it's essential to be aware of which transactions are affected.

Always review your card's specific terms regarding grace periods, as some cards may not offer one at all—particularly those targeted at borrowers who frequently carry balances.

Taking advantage of the grace period can significantly save you money and help you manage your finances effectively.

7. Rewards and Cashback

Many cards come loaded with rewards programs, including cashback or points that can be utilized for various benefits. Understanding how these rewards systems work is essential for maximizing your gains when using the card.

Different cards have varying structures for earning rewards, such as bonus categories for specific spending (gas, groceries) or flat cashback percentages across all purchases. Be sure to check if there are caps or expiration dates on rewards, as these details can affect your overall benefit.

To maximize your rewards, consider aligning your purchases with the categories that offer higher returns, whether that’s groceries, dining, or travel.

- Check if there’s a cap on rewards

- Look for terms about points expiration

- Analyze which purchase categories earn the most

Familiarizing yourself with the rewards system can turn your credit card into a beneficial financial tool rather than a burdensome debt.

How to Read and Understand Credit Card Terms and Conditions

Credit card agreements can seem overwhelming, filled with legal jargon and complicated terms. However, taking the time to read and understand these documents is vital. Start by focusing on the key sections that clearly outline your responsibilities and potential fees, such as the fee schedule and APR disclosures.

Next, don’t hesitate to reach out to customer service if you encounter any unclear terms or complex calculations. They are there to help and can clarify details or provide further explanations that will help you understand your credit card terms thoroughly.

Lastly, consider doing research or seeking advice from financial experts, as they can provide additional insights about what to look for in credit card agreements.

- Examine the fee schedule carefully

- Look for sections detailing interest rates

- Identify the penalties for late payments

Be proactive about your understanding of credit card terms, as this can save you from future financial distress.

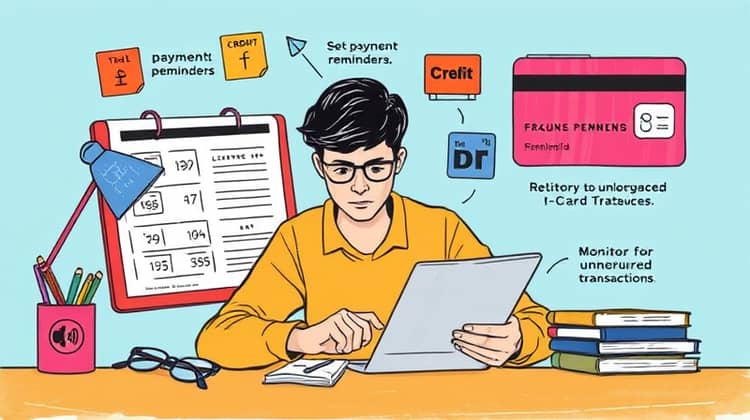

Best Practices to Avoid Unpleasant Surprises

To avoid surprises associated with credit card fees, start by carefully tracking your spending and payments. This helps ensure that you stay within your limits, pay on time, and avoid late fees.

Another important practice is to regularly review your credit card statements. This keeps you informed about any changes in terms, fees, or rewards offerings that might affect your financial commitments.

- Set up payment reminders or automatic payments to avoid missed payments

- Monitor your account for unauthorized transactions

- Evaluate your credit card usage regularly and adjust as necessary

Staying vigilant and proactive can protect you from unpleasant surprises and ensure that you use your credit card effectively.

Conclusion

Understanding credit card terms and conditions is not just about avoidance of fees; it’s a crucial aspect of managing your financial health. By taking the time to evaluate the specifics of what every term means, you can harness the benefits that credit cards offer without falling victim to their pitfalls.

As a consumer, you hold the power. Knowledge is your greatest ally in dealing with credit cards. From interest rates to rewards, being informed prepares you to use credit responsibly and advantageously. This approach allows you to enjoy the financial flexibility cards offer while maintaining a healthy credit score and financial standing.

Ultimately, the goal is not just to spend but to spend wisely. By arming yourself with the right information, you set yourself on a path toward financial success and peace of mind.