Navigating the world of student loans can feel overwhelming, particularly when seeking relief options like deferment and forbearance. Both of these strategies allow borrowers to temporarily postpone or reduce their payments, yet they come with significant differences. Understanding these options is essential for any student loan borrower facing financial difficulties.

In recent years, the growing student debt crisis has pushed many borrowers to seek various methods to manage their financial burdens. The ability to pause payments or reach a more manageable repayment situation is vital during these trying times when other financial responsibilities also weigh heavily. Deferment and forbearance are two solutions that borrowers frequently consider, and it's crucial to grasp what each one entails.

This article delves into the specifics of deferment and forbearance while providing guidance on when to choose each option based on individual circumstances. Whether you're struggling to make payments or simply want to explore your options, understanding these two terms is the first step toward regaining control over your student debt.

Student Loans in Crisis

The issue of student loan debt has reached a critical point, with millions of borrowers grappling with financial stress caused by their educational expenses. The aggregate student debt in the United States has reached over $1.7 trillion, representing a looming crisis for borrowers and the economy alike. More individuals are struggling to keep up with payments, leading to an increasing need for options like deferment and forbearance.

For many, the burden of monthly payments can be insurmountable, particularly for recent graduates who may be entering a challenging job market. As businesses adjust to economic changes, new graduates often find themselves in lower-paying jobs or facing prolonged unemployment. These circumstances create a pressing need for financial relief, making it crucial to understand how deferment and forbearance can help ease the strain.

Understanding the ramifications of student loans is vital for borrowers to make informed decisions about repayment strategies. The potential for deferment or forbearance may provide a temporary respite from financial obligations, but it's important to consider the long-term effects on credit scores and overall financial health.

What are Deferment and Forbearance?

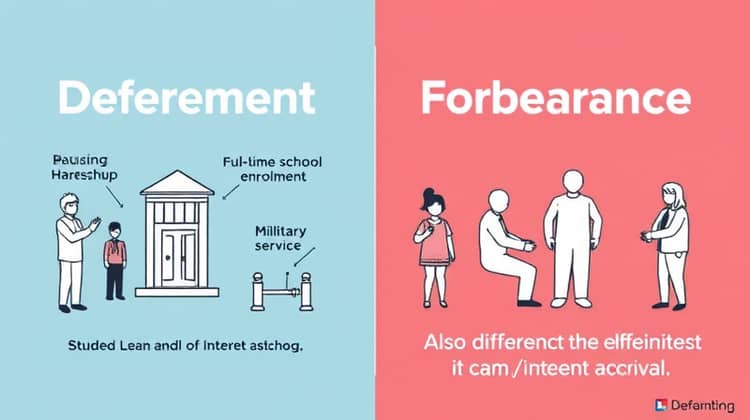

Deferment and forbearance are two options available to student loan borrowers seeking temporary relief from their payment obligations. Both options allow borrowers to pause or reduce their payments; however, they differ in terms of eligibility criteria, interest accruement, and the types of loans they cover. Understanding these differences is crucial for making an informed choice that best suits a borrower’s financial situation.

Deferment is a status that temporarily suspends payments on federal student loans without interest accruing on subsidized loans during the deferment period. This can provide significant relief for borrowers who qualify under specific circumstances such as financial hardship, full-time enrollment in school, or serving in the military. However, forbearance does not provide the same interest benefits, as interest may still accrue on both subsidized and unsubsidized loans.

On the other hand, forbearance is typically granted when borrowers are unable to make their loan payments due to temporary financial difficulties. This option is generally easier to obtain but comes with the caveat that interest will continue to accumulate even if payments are not made. Recognizing these nuances between deferment and forbearance is essential for choosing the right path to navigate student loan responsibilities.

Key Differences between Deferment and Forbearance

While both deferment and forbearance offer a temporary reprieve from monthly payments, the key differences lie in how interest is handled and the eligibility requirements. Borrowers may be eligible for deferment if they meet specific conditions, whereas forbearance is more broadly available for anyone facing financial hardship, regardless of their situation.

It's important for borrowers to evaluate their specific circumstances, as the choice between deferment and forbearance can have significant long-term effects on their loan balance and repayment journey.

- Both options allow temporary pauses in payments.

- Interest accrual differs: Interest does not accrue during deferment for subsidized loans but does during forbearance for all loan types.

- Deferment typically requires specific qualifications, while forbearance is generally easier to obtain.

Understanding these differences can aid borrowers in making an informed decision that aligns with their current financial condition and long-term repayment goals.

When to Choose Deferment

Borrowers should consider deferment if they meet specific eligibility requirements or anticipate a return to stable financial conditions soon. Deferment can be a better option when managing educational expenses, military service, or if you're pursuing additional education, especially when you have subsidized loans.

Additionally, if your situation allows you to qualify for deferment, the advantage of not accruing interest on your subsidized loans can lead to substantial savings over time. However, careful consideration must be given to whether these circumstances will change, and the borrower will eventually need to resume payments responsibly.

- You are enrolled in school at least half-time.

- You are facing unemployment or economic hardship that meets specific criteria.

- You are experiencing a medical emergency or serious illness.

Choosing deferment when eligible can provide beneficial financial breathing room while planning for future repayment strategies.

When to Choose Forbearance

Forbearance is best suited for borrowers experiencing temporary financial difficulties that do not meet the criteria for deferment. If you find yourself in a situation where payments are unmanageable but you do not qualify for deferment, forbearance can give you much-needed relief in the short term.

- You are unable to make your monthly payment due to temporary financial hardship.

- You require more flexibility in managing your payments than deferment would allow.

It's important to remember that while forbearance offers immediate relief, the building interest could affect your financial situation once you are back on track.

Impact on Your Credit Score

The choices borrowers make regarding deferment and forbearance have far-reaching implications for their credit scores. While both can temporarily relieve financial stress, that relief comes with important trade-offs worth considering. For instance, neither deferment nor forbearance is typically reported as a negative mark on a borrower's credit report, provided that their loans are in good standing before requesting either option.

However, the accrual of interest during forbearance can lead to increased total loan balances, which may ultimately affect borrowers when they resume payments. A higher loan balance may impact debt-to-income ratios, which are evaluated by lenders when considering future credit applications or loans. This is an important factor for borrowers to consider before choosing either option.

Additionally, if payments are missed or you default after entering a forbearance period, that can negatively affect your credit score quite severely. Monitoring your credit status and understanding the rules around deferment or forbearance is imperative in maintaining a healthy credit profile.

Finally, borrowers should remain aware that taking advantage of deferment or forbearance will affect their overall repayment term. Understanding the sacrifices made during these periods of inaction is key to successfully navigating life after student debt relief.

Alternatives to Deferment and Forbearance

For borrowers not qualifying for deferment or who wish to avoid the pitfalls of forbearance, there are alternative strategies available that might provide greater long-term benefits. One option could be loan consolidation, which combines multiple loans into a single loan with potentially lower interest rates or payments. Alternatively, income-driven repayment plans can adjust monthly payments based on a borrower’s income, making it easier to manage payment responsibilities while staying on track financially.

Another alternative might include seeking part-time employment or side gigs to generate additional income that can help cover loan payments. Borrowers should actively explore these possibilities as they may offer solutions that align better with their long-term financial goals.

- Loan consolidation.

- Income-driven repayment plans.

- Seeking part-time employment or income opportunities.

By being proactive and exploring various repayment strategies, borrowers can regain control over their financial future in a way that deferment and forbearance may not provide.

How to Apply

Applying for deferment or forbearance is a relatively straightforward process, but it requires thorough preparation and understanding of your loan details. To start, borrowers should gather all necessary documentation that demonstrates their current financial situation, including income statements, employment records, and any additional situational context that supports their application.

Next, borrowers can initiate the process by contacting their loan servicer or lender, as they can provide specific forms to fill out and detail the eligibility criteria for both options. Make sure to follow the instructions closely, and be ready to provide any required documentation promptly.

Finally, after submitting your application, it's essential to keep an eye on the loan status and confirm that the deferment or forbearance has been processed correctly. Staying communicative with your loan servicer is crucial during this stage to ensure that everything is handled under the proper regulations.

Conclusion

Understanding the distinctions between deferment and forbearance is vital for student loan borrowers seeking to manage their debt strategically. While both offer temporary solutions to payment difficulties, they come with different implications that can affect overall financial health and credit ratings.

By carefully determining your eligibility and considering your future financial situations, you can make an informed decision that aligns with your needs. Ultimately, whether you choose deferment or forbearance—or explore alternatives—requires careful navigation to ensure the best available outcomes for managing your student loan burden.

Remember, student loans represent a significant long-term commitment, so being proactive about your repayment plans and regularly assessing your options can make a substantial difference in your financial well-being.