In today's digital age, online shopping has become more popular than ever. However, with the convenience of online transactions comes the risk of fraud and identity theft. To combat these issues, many consumers are turning to virtual credit cards as a safe and secure alternative for their online purchases.

Virtual credit cards offer a unique solution that allows users to shop online with peace of mind. By generating a temporary card number linked to their actual credit account, shoppers can protect their sensitive information while enjoying the benefits of cashless transactions.

This blog post will explore the rise of virtual credit cards, how they work, their benefits and drawbacks, and tips for using them safely. It will also provide insights into the future of virtual credit cards in the ever-evolving landscape of digital finance.

The Rise of Virtual Credit Cards

Virtual credit cards have seen a significant increase in popularity over recent years. As more consumers become aware of the potential dangers associated with online shopping, the demand for secure payment methods rises.

Many financial institutions and payment platforms have jumped on board, offering virtual credit cards to meet this growing need. These services allow customers to generate a unique card number with each transaction, which greatly reduces the risk of fraud.

As technology continues to advance, virtual credit cards are becoming an essential tool for online shoppers looking to safeguard their personal and financial information.

How Virtual Credit Cards Work

At their core, virtual credit cards operate similarly to traditional credit cards. However, instead of using a physical card, users generate a temporary card number that is linked to their actual account.

This temporary number can be used for online purchases and has a predefined limit or expiration date, providing an added layer of security. If a hacker gains access to the temporary number, it won't compromise the owner's real credit info.

The process of obtaining and using a virtual credit card is straightforward, making it an accessible solution for most consumers.

- Select a service provider or bank that offers virtual credit cards.

- Create an online account with the provider and link your existing credit card or bank account.

- Generate a new virtual credit card number for your online transactions. Make sure to set a spending limit or expiration date for enhanced security.

Using virtual credit cards is a great way to mitigate risks associated with online shopping. By relying on temporary card numbers, users can shop without exposing their sensitive financial information. This not only safeguards their primary accounts but also encourages more secure purchasing habits.

In addition, the ease of generating and managing virtual cards makes them an appealing option for consumers looking to streamline their online shopping experience.

Benefits of Using Virtual Credit Cards for Online Shopping

The benefits of virtual credit cards extend beyond just enhanced security. For consumers, these cards can offer a level of convenience that is often unparalleled in traditional payment methods.

Virtual credit cards allow users to create unique numbers for different merchants or transactions, helping them keep track of their purchase history and spending patterns more effectively.

- Increased security against fraud and identity theft.

- Convenience of temporary numbers for each transaction, reducing exposure.

- Ability to control spending limits and expiration dates easily.

With these advantages, virtual credit cards have become a top choice for many consumers who shop online regularly. They offer not just peace of mind, but also enhance the overall shopping experience.

As the digital world continues to expand, the trend of adopting such secure payment methods is likely to grow, proving beneficial for both consumers and merchants alike.

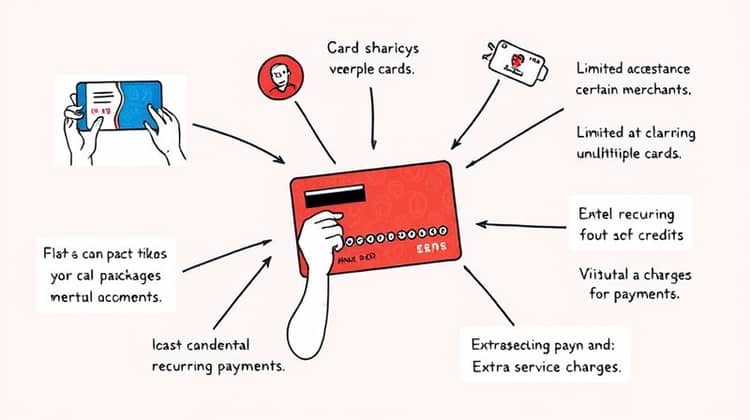

Potential Drawbacks of Virtual Credit Cards

Despite their benefits, virtual credit cards are not without their drawbacks. Some consumers may find the process of generating numbers and managing multiple cards cumbersome or confusing.

- Limited acceptance at certain merchants or service providers.

- Potential issues with recurring payments if the virtual card expires or is not renewed.

- Some virtual card services may charge fees for their usage.

These factors may deter some individuals from fully embracing virtual cards for their online shopping needs. However, for those willing to navigate these challenges, the protections and flexibility offered can outweigh the inconveniences.

How to Get Started with Virtual Credit Cards

Getting started with virtual credit cards is a simple process that can be completed online in just a few minutes. The first step is to choose a reliable provider that fits your needs.

Once you've selected a provider, the next step is to create an account. This typically requires you to link your traditional credit card or bank account, allowing the virtual card to draw from that source.

After your account is set up, you can easily generate virtual credit card numbers for your online purchases, ensuring your actual information remains confidential.

- Research and compare providers to find the best fit for your needs.

- Open an account with the chosen provider and link your existing financial accounts.

- Start generating virtual card numbers for safe online transactions.

By following these simple steps, anyone can begin using virtual credit cards and enjoy a safer online shopping experience. It's a small change that can have a significant impact on protecting sensitive information.

Tips for Using Virtual Credit Cards Safely

While virtual credit cards provide an added layer of security, users must still take precautions when using them online. The first step is to ensure that you are shopping on secure and reputable websites. Look for URLs that begin with 'https' and check for security certificates before entering payment information.

Additionally, always monitor your financial statements for unauthorized charges, as early detection can help prevent further issues.

- Use unique passwords for your virtual card accounts and change them regularly.

- Avoid sharing your virtual card details or PIN with anyone.

- Keep your computer and browser updated to protect against malware.

By adhering to these safety tips, you can further enhance your online shopping experience and ensure that your virtual credit card transactions are as secure as possible.

The Future of Virtual Credit Cards

Looking ahead, the future of virtual credit cards appears bright, as more consumers become aware of the benefits they offer. With the growing emphasis on online security, virtual cards are likely to gain further traction amongst shoppers of all demographics.

As technology continues to evolve, we may also see innovations in virtual card features, such as enhanced tracking for spending and integration with digital wallets and cryptocurrencies.

These advancements could make virtual credit cards an even more attractive option for consumers, helping to streamline the online shopping experience while providing unparalleled security.

Conclusion

In conclusion, virtual credit cards represent a significant advancement in online shopping security. They offer consumers the ability to protect their financial information while enjoying the convenience of digital transactions.

As online shopping continues to grow, embracing tools like virtual credit cards can help consumers navigate potential risks and enhance their overall purchasing experience.